[vc_row gap=”10″][vc_column width=”5/6″][vc_column_text css=”.vc_custom_1758645606264{margin-top: 0px !important;}”]

Preface

The Scaling Community of Practice (SCoP) launched an action research initiative on mainstreaming scaling in funder organizations in January 2023. This initiative has three purposes: to inform the SCoP members and the wider development community of the current state of support for and operationalization of scaling in a broad range of development funding agencies; to draw lessons for future efforts to mainstream the scaling agenda in the development funding community; and to promote more effective funder support for scaling by stakeholders in developing countries. (For further details about the Mainstreaming Initiative, see the Concept Note on the SCOP website). The Mainstreaming Initiative is jointly supported by Agence Française de Développement (AFD) and the SCoP. The study team consists of the co-leaders, Larry Cooley (Co-Chair of the SCoP), Richard Kohl (Lead Consultant) and Johannes Linn (Co-Chair of the SCoP), and of Charlotte Coogan (Program Manager of the SCoP) and Ezgi Yilmaz (Junior Consultant). MSI staff provide administrative and communications support, in particular Leah Sly and Gaby Montalvo.

The principal component of this research is a set of case studies of the efforts to mainstream scaling by selected funder organizations. These studies explore the extent and manner in which scaling has been mainstreamed, and the major drivers and obstacles. The case studies also aim to derive lessons to be learned from each donor’s experience, and, where they exist, their plans and/or recommendations for further strengthening the scaling focus.

This document brings together two companion case studies of USAID’s Feed the Future Initiative:

- Feed the Future Scales Up: Lessons Learned from the Feed the Future Initiative 2011–2020

- Addendum to Feed the Future Scales Up: Lessons Learned from the Feed the Future Initiative 2020–2024

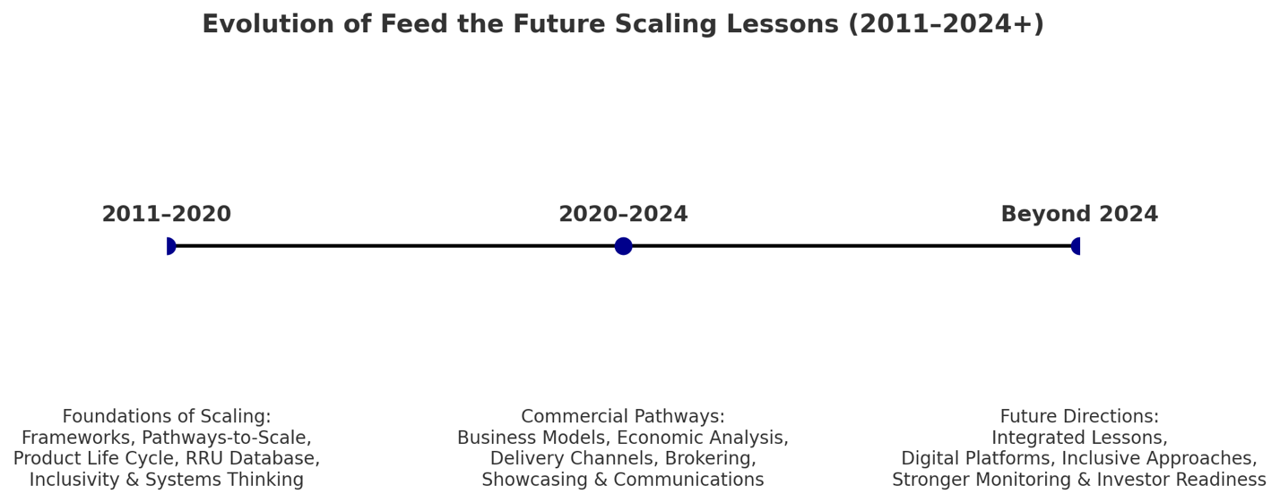

Originally prepared as stand-alone analyses, the two studies capture lessons from distinct phases of the Feed the Future journey. The first report reflects a decade of work describing the conceptual and systems-level foundations of scaling—developing frameworks, testing pathways, and building an evidence base for how innovations could move beyond pilot stages into wider systems. The second, covering the subsequent four years, covers lessons on commercially viable pathways, business models, and investor-ready approaches for transitioning research outputs into market adoption.

Merging the two documents into a single volume provides a comprehensive record of learning across 2011–2024. It preserves the chronological flow while also offering an integrated perspective on how scaling practices have evolved.

This Study serves as both a historical reference and a forward-looking guide for donors and scaling practitioners. It demonstrates that while approaches may vary—from frameworks and enabling environments to commercialization and partnerships—the underlying objective remains constant: ensuring that agricultural research and development (R&D) innovations reach the markets and users at a level to transform food systems, improve resilience, and advance global food security goals.

This Study complements two prior case studies on the experience with scaling under Feed the Future published as part of the SCoP’s Initiative on Mainstreaming Scaling in Funder Organizations:

- Mainstreaming Scaling Initiative Case Studies: Feed the Future

- Mainstreaming Scaling: A Case study of USAID-Funded Research Outputs from Feed the Future’s Innovation Laboratories

[/vc_column_text][vc_toggle title=”CLICK HERE TO READ MORE” custom_font_container=”tag:h4|text_align:left” custom_google_fonts=”font_family:Montserrat%3Aregular%2C700|font_style:700%20bold%20regular%3A700%3Anormal” icon=”0″ icon_closed=”0″ use_custom_heading=”true”]

Executive Summary

Over more than a decade, in addition to investment in agriculture R&D, Feed the Future (FTF) has also advanced the science and practice of scaling agricultural innovations, shifting from early lessons on pathways and enabling environments (2011–2020) to more recent emphasis on commercialization and business-led adoption (2020–2024). These experiences have demonstrated that scaling is neither automatic nor linear. It requires intentional and early design, context-appropriate pathways, effective partnerships, and increasingly, viable business models that link innovations to market demand.

Lessons from 2011–2020: Building the Foundations

During this period, USAID’s Bureau for Food Security established a pathways-to-scale framework grounded in economic theory, developed a Product Life Cycle (PLC) approach for research investments, and compiled a Research Rack-Up (RRU) database of over 1,500 innovations. Lessons emphasized:

- Start with scale in mind: assess scalability early using user-centered criteria.

- Select the right delivery pathway: private, public, or public-private partnership, depending on the good’s characteristics.

- Engage the right partners: aligning private sector, donors, and governments.

- Design for inclusivity: ensuring women, youth, and marginalized groups are not left behind.

- Adapt locally: using iterative, evidence-based approaches with local partners.

- Track diffusion and impact: going beyond direct program participant counts to measure real-world adoption.

This decade established the theoretical and operational foundations of innovation scaling while underscoring persistent challenges in diffusion tracking, market intermediation, and sustaining uptake beyond donor cycles.

Lessons from 2020–2024: Prioritizing Commercial Pathways

The subsequent period built directly on these foundations, sharpening focus on commercial scaling as the most viable pathway for many innovations. This period highlights that while public and public-private pathways remain important, widespread and sustainable uptake requires business models that are profitable, investable, and connected to effective delivery channels. Key findings include:

- Business models drive scale: exploring how an innovation can make money by describing the problem it solves; the target or market segment that will use the innovation; the revenue streams and cost structures; and the delivery channels, partnerships, resources and operations that will deliver the innovation.

- Critical data and planning are needed to provide input into the business model:

- Economic analysis is critical: standardized cost-benefit data (production costs, ROI, market size) is essential for investor engagement and digital platform dissemination.

- Delivery channels matter: agrodealers, cooperatives, fabricators, business service providers (BSPs), Business to Business (B2B) relationships, distributors, licensing arrangements, and digital platforms are critical conduits to reach farmers and markets. Each offers unique advantages and limitations.

- Showcasing works—with preparation: trade shows and virtual showcases can spark demand but require investor-ready materials with specific data.

- Brokering and partnerships accelerate uptake: tailored matchmaking between innovators, investors, and distributors bridges the gap between demonstration and adoption.

- Communication strategies must be embedded early: prospectuses, sell sheets, and investor-oriented and marketing materials should be part of the R&D process from the outset.

Looking Across 2011–2024: Toward Sustained Scaling

Taken together, the two phases show an evolution in understanding scaling:

- From theoretical frameworks and systems orientation (2011–2020) to commercialization and investor readiness (2020–2024).

- From focusing primarily on innovation characteristics and enabling environments to prioritizing business models, economic viability, and delivery channels.

- From donor-driven facilitation to market-driven partnerships that can sustain adoption beyond program cycles.

The way forward will require integrating both sets of lessons: continuing to plan for scale from the earliest stages of research, while embedding business model design, economic analysis, and communication strategies to ensure commercial pathways can succeed. Future efforts should also strengthen inclusive approaches, leverage digital platforms, and refine monitoring methods that capture true diffusion and impact at scale.

By institutionalizing these practices, scaling practitioners can ensure that research investments not only generate innovations but also deliver them at the scale and speed required to transform food systems, strengthen resilience, and improve incomes and nutrition worldwide.

1.0 Feed the Future Scales Up (2011–2020)

1.1 Aim of Section 1.0

The purpose of this section is to:

- Share lessons learned from over a decade of scaling Feed the Future-funded research and innovation;

- Introduce a framework for innovation commercialization and scaling;

- Explain the theoretical foundations behind this framework;

- Recommend a path forward for coordinated scaling efforts across stakeholders.

A Decade of Learning. The Bureau for Resilience, Environment, and Food Security (REFS) – then known as the Bureau for Food Security – first embarked on its journey to scale up programs and innovations in Feed the Future target and aligned countries in 2013. At that time, USAID missions in target countries initiated a series of “Scaling Action Plans” with the intent to identify a limited set of technologies that could advance sustainable, broad-scale, high-impact scaling. This undertaking was accompanied by Global Learning and Evidence Exchange events to advance missions’ efforts by facilitating information exchanges. Concurrently, REFS engaged scaling-up experts through literature review, case studies, and expert roundtables to put scaling-up strategies into practice. Since then, REFS has built up a body of work drawing on the lessons learned from these (and others’) experiences. Staff developed and validated a framework for scaling up as the basis of an Agriculture Scalability Assessment Toolkit and documented some successes of scaling certain innovations.

Among the most important lessons learned over the decade are:

-

- Design for Scalability

- Assess scalability as early as possible. Identify the prospects and likely challenges that will be faced, which allows everyone involved to make informed decisions about whether and how to proceed, and to take specific steps to mitigate potential scaling obstacles or negative externalities. Key parameters for assessing scaling potential are: importance of the problem, credibility of the solution, ease of adoption, business case for users, business case for the market system, and the enabling environment.

- Plan for scale upfront. Design projects and innovations with scale in mind. Plan an exit strategy, with indicators and milestones, without defaulting to an invisible hand, assuming the market will simply lead to scaling up.

- Different models need to be considered. A pilot program may scale from an implementing partner to intermediary organizations that then drive systems change.

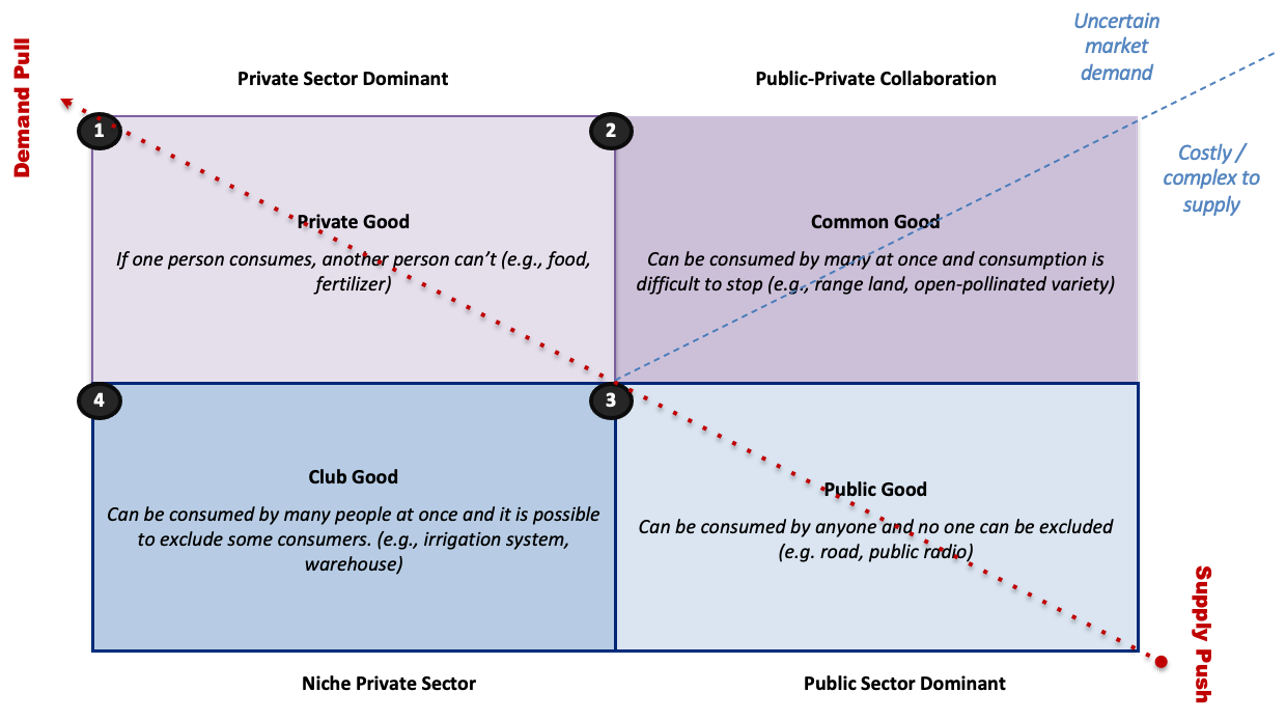

- There are different pathways to scale depending upon the characteristics of a good or service, including whether these characteristics lend themselves to commercial pathways, public-private partnership pathways that are supply constrained, public-private partnership pathways that are demand constrained, public pathways, or bundles of goods, necessitating leadership and involvement of different stakeholders. Strengthening of these pathways can contribute to systems change.

- The most appropriate scaling pathway largely depends upon whether the characteristics of the innovation to be scaled are predominantly private, public, club or common goods (see Section 1.3).

- Implement and Deliver

- Factors that facilitate achieving scale include a conducive enabling environment that supports trade and movement of, and access to, goods, services and information, an inclusive and accessible financial system, functioning infrastructure, and protection of public and private resources, including intellectual property rights.

- In order to scale innovations for development, evidence suggests a strong preference for private sector scaling based on two assumptions. First, in many middle- and low-income countries the public sector lacks the resources, incentives, and ability to scale. Second, donors have neither the mandate nor resources to support scaling beyond five to ten years. If scaling a particular innovation is profitable for private sector actors, it is likely to be sustainable and eventually approach maximum scale potential. Despite the preference for private sector scaling, research suggests that other stakeholders, including public sector actors, play important intermediary and supporting roles, e.g., regulatory approval and quality assurance, extension and marketing that raises awareness of novel products to drive demand, trains end users to properly use them, and supports a feedback mechanism linked to research and innovators.

- Market and other intermediaries play critical roles in scaling and are often the missing factor when no other entity can drive scale. Few interventions or innovations transition successfully to scale without someone performing a variety of “intermediation” functions. Now crop varieties or fertilizer formulations, for example, are unlikely to reach farmers without the intermediation of seed companies and agrodealers.

- When markets fail, public-private partnerships (PPPs) can be leveraged to play essential roles — with the right institutional arrangements and incentives, as evidenced by the PPPs that supply early generation seeds for many crops. When markets are more robust PPPs are likely to be supplanted by profit-seeking firms.

- Donors can serve to safeguard and facilitate inclusive scaling alongside local actors and may be indispensable when there are strong public benefits and a willing but under-resourced public sector and/or commercial partner. Donors can play this facilitation role by linking up investors, safeguarding and de-risking finance, and linking manufacturers and distributors to small- and medium-enterprises, or other entities that could benefit from the product or service, and supporting extension or training.

- The choice of business model may be the difference between success and failure for an innovation.

- Design for Scalability

- Support inclusive access

- Scaling pro-poor agricultural products and services should be accompanied by finance at a matching scale, which is contingent on significantly reducing the risk or transaction costs associated with investment in pro-poor food systems.

- Government and/or donor action is often required to promote inclusive market development when the private sector is unwilling or unable to absorb the costs of reaching remote and dispersed smallholders or other disadvantaged groups.

- Monitor and Adapt

- Monitoring impact is complicated; there are few feedback mechanisms and the ones that exist are costly, especially for less commercial technologies for which there are fewer incentives to track diffusion.

1.2 REFS and GFSS further integrate scaling

In 2020, USAID and missions doubled down on systems approaches to agricultural development, particularly with the global recognition of a “food systems” approach. Over the decade since the Feed the Future Initiative’s inception, understanding of scaling programs, likewise, shifted toward a systems-oriented view.

The Global Food Security Strategy (GFSS), which guided the Feed the Future Initiative, embedded a “scaling up agenda” as one of its core commitments, including:

- Making innovation scaling central to food security programming – ensuring that R&D, interventions, and partnerships were designed not just as pilots or short-term projects, but with the explicit goal of achieving widespread, sustainable adoption of innovations and approaches.

- Embedding scaling into the research-to-use pathway – using the Product Life Cycle (PLC) approach and pathways-to-scale framework to evaluate innovations early, identifying those with high potential, and prioritizing investments that could realistically achieve impact at scale.

- Leveraging multiple pathways – recognizing that different innovations require different delivery models: private-sector markets for commercial goods, public programs for public goods, and public-private partnerships for common goods and practices.

- Strengthening enabling environments – addressing the policy, institutional, and market conditions necessary to allow scaled innovations to spread, adapt, and persist, including incentives for local and private-sector actors.

- Prioritizing inclusivity and systems thinking – ensuring that women, youth, and marginalized groups were not left behind, and framing scaling within a broader food systems perspective rather than focusing only on individual crops or technologies.

- Building accountability for scale – incorporating expectations that USAID missions, implementing partners, and researchers integrate scalability assessments, economic analysis, and monitoring of real-world diffusion into their program design and reporting.

During reorganizations and revisions beginning in 2020, scaling became more widely recognized as integral to achieving the GFSS objectives of reducing poverty, hunger, and malnutrition. In March 2020, REFS restructured from the Bureau for Food Security to the Bureau for Resilience and Food Security and reaffirmed its commitment to scaling, evident in the new strategic roles and teams that were created, such as the Center for Agriculture-led Growth’s Commercialization and Scaling Team and the Technology Transfer Team.

The updated GFSS, was released in October 2021. Scaling up was more widely recognized as integral to achieving the GFSS objectives of reducing poverty, hunger, and malnutrition with 91 references to scaling up programs or innovations. GFSS Objective 1:, ‘Inclusive and sustainable agriculture-led economic growth,’ highlighted the need to strengthen the public and private delivery pathways that get cutting-edge innovations and information into the hands of producers and entrepreneurs:

Inclusive and sustainable agriculture-led growth requires widespread adoption of improved technologies, practices, and approaches by all system actors, including local service providers, input suppliers, smallholder producers, and processors…by developing and strengthening public and private delivery pathways to link appropriate solutions to demand.

The GFSS scaling-up agenda also referenced food systems, nutrition, climate change adaptation technologies, supply chains, capacity development, and research approaches.

GFSS defined the scaling of proven technologies and practices as, “the process of sustainably increasing the adoption and diffusion of a credible technology or practice, or a package of technologies and practices, to retain or improve upon the demonstrated positive impact of the technology or practice and achieve widespread use by stakeholders.” Adoption of improved technologies and practices by a small number of adopters will not accomplish development goals. In order to yield maximum impact, the widespread adoption of improved technologies and practices must be achieved.

The GFSS Technical Guide for Scaling provided guidance for incorporating the scaling of improved technologies and practices into development efforts aimed at reducing hunger, malnutrition, and poverty. Proven wide-scale adoption, as witnessed in the Asia and Latin America Green Revolutions, is transformative and affects sustainable economic development.

REFS supported a facilitative approach that strengthened the actors and their respective functions that make up the public and private scaling pathways at the systems level, diffusing innovations beyond program boundaries and allowing for widespread adoption of improved technologies and practices at the population level (e.g., hundreds of thousands to millions).

1.3 Scaling up programs and systems change

In distinction from scaling up individual technologies, there are several ways to define “scale up” of programs., When referring to the scaling up of programs, it means that impact is being scaled, rather than increasing only the number of program participants or beneficiaries, outputs or approaches. This meaning aligns most closely with what has been referred to as “transformational scale”, or “…creating significant change by engaging with a broader and deeper number of systems to create more space for scaling…” Programmatic scale should be understood as changes in behavior, benefits, and other outcomes facilitated by the program, linked to a corresponding change in underlying incentive structures that influenced these.

This concept of transformational scale matters when considering activities’ roles (pilot or other stage), the tools to implement them, and how they facilitate systems change at scale. Programmatic scaling may begin with pilot activities to determine the efficacy of an approach, of a technology, or to achieve certain results. Not all pilots can be expected to reach scale, but while donors have had some successes a significant number of cases do not scale. Activities and pilots can also generate evidence to support the effectiveness of specific interventions, perfect an innovative method, or ground-truth an approach in different countries and contexts. However, much as technologies must be developed with scale in mind from the beginning, activities must be designed with a vision for impact beyond the life of a program.

Finding ways to lay the groundwork for scaling, pivot to a new entry point, transfer an innovative pilot, adapt to push on a different lever, or determine when to abandon an intervention, are all important to set the stage for impact at scale.

For a program to scale, it must be catalytic and effect sustainable change in a food or other system and achieve broad impact. These changes take time and don’t fall neatly within a five-year program cycle. There is an incentive to focus on increased beneficiary numbers and other easily reportable indicators. Additionally, measuring significant change and outcomes are challenging. Increased investments in consistent monitoring, impact studies, and ex-post studies can help drive change toward assessing program impact. See Appendix One for two examples of what successful scaling programs can look like in practice.

1.4 Frameworks for scaling up innovations

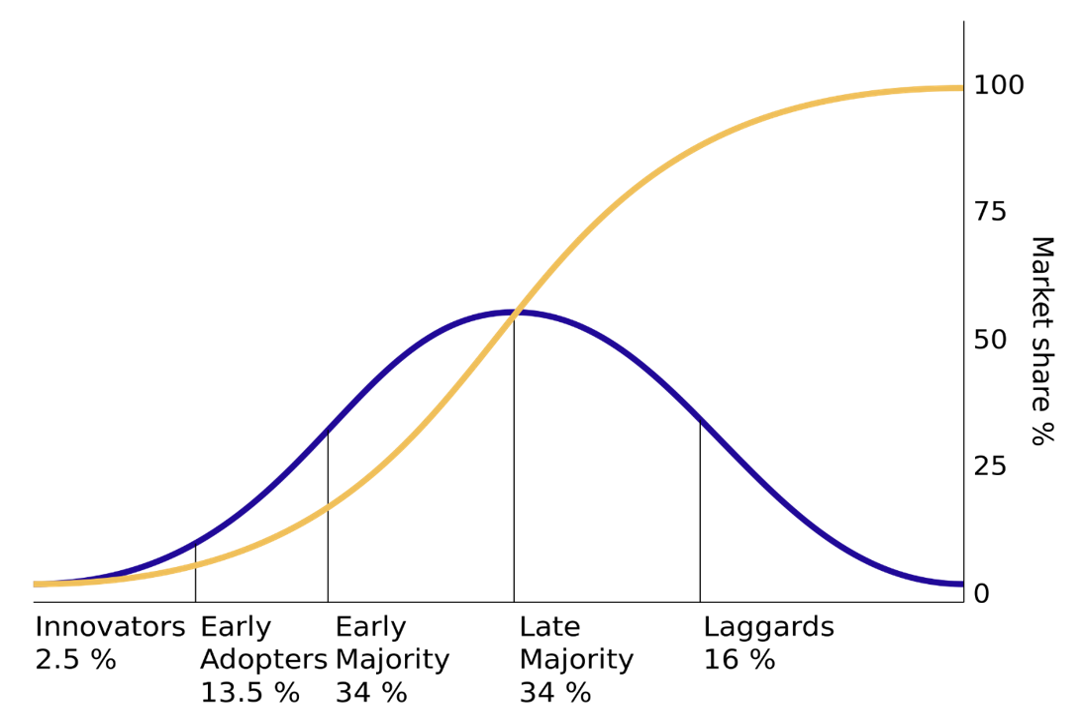

In contrast to scaling up a program from a pilot to higher-level systems change, scaling up an individual innovation may or may not require changing a system. “Innovations” are products, services, or practices that are original and can be useful for adopters. The familiar scaling sequence of innovations is an S-curve, depicted as follows:

“Takeoff” is the key inflection point from which an innovation scales through indirect diffusion driven by user demand and natural market forces. The takeoff point varies with the type of good. Consumer goods companies typically plan for a 16.6% adoption rate for takeoff. REFS’ experience is that agricultural goods reach takeoff when the adoption rate is estimated to be between 25 percent – 35 percent of a potential market. Understanding the takeoff point for an innovation is critical because it suggests how much donors and implementers need to invest in linkages, market actors, and delivery pathways in a particular market before adoption occurs naturally.

REFS commissioned several studies on innovation scaling which provided the theoretical underpinnings for future work on scaling research.

REFS, with other partners, documented, developed, tested, and refined a scaling-up framework for assessing pathways to scale. This framework is grounded on well-established economic theory, originating from research on the economic theory of goods, and applied in Feed the Future to constraints to early generation seed use and scaling case studies.

In this framework, products and services have particular characteristics that facilitate their scalability as follows:

- Private goods: Access is based on payment, or some form of remuneration and non-payers are effectively excluded from use of the good. Private enterprises are the means through which scaling is achieved. Examples of private goods include everything from fertilizer to harvested crops.

- Common goods: Access is not controlled by payment, but access to the resource is restricted to entitled users. Such goods are subject to demand constraints mainly due to issues of demand uncertainty or supply constraints because of high costs or delivery complexities. Public-Private partnerships or related institutional arrangements are necessary to address such constraints. Rangelands are a classic example of common goods.

- Club goods (niche private sector): Access is based on payment, but the goods can be simultaneously used by multiple consumers until congestion occurs, or rationing is necessary. Private enterprises achieve scale of these goods until demand is met, at which point it typically collapses, or demand must be tightly managed. An irrigation system is a club good. A grain elevator functions much like a club good when 100 percent capacity utilization is reached, demand for more grain collapses.

- Public goods: Access is not controlled by payment, and the goods can be simultaneously accessed by multiple consumers. Public goods are the responsibility of governments (or, temporarily, donors) to deliver, although with the right institutional arrangements there may be private delivery options. Roads for transporting grain are public goods.

Private goods are subject to demand-pull by markets; that is, there are profitable financial returns to individual actors, which incentivizes them to participate actively in the market. Public goods are subject to supply-push forces as there are low- to no- returns to individual actors.

Scaling up products and services follow one of the foregoing trajectories. Scaling up practices, for which often there is no demand-pull, typically requires a bundling strategy where a practice can be bundled with a product or service that is in demand. Otherwise, if there are no bundling opportunities, practices will have to scale through the public sector.

The objective of this framework is to help stakeholders understand how the type of good—private, common, club, or public—shapes the pathways and constraints for scaling. By diagnosing the nature of the good, practitioners can identify whether market incentives, public–private partnerships, or public provision are most appropriate. The framework can thus be used as both a learning tool, to interpret past experiences with scaling, and a practical guide, to design future interventions and align scaling strategies with the institutional arrangements most likely to succeed.

1.5 Case Examples and Evidence from the Research Rack Up

Feed the Future Innovation Labs generated a collection of innovations, including but not limited to new crop varieties, improved practices, and better technologies, for which data was cataloged in a basic, MS Excel-based database internally referred to as the Research Rack Up (RRU). Data collection started in 2015 and included innovations from as early as 2011 and covered information as technology name, description, various categorizations of the technology, implementing partner, stage of research, and other information. The innovations in the RRU represented a decade of investment in Feed the Future in solving problems that plague smallholder farmers and others in agriculture and food systems through research solutions.

As of end 2021, over 1,500 innovations in the RRU had reached the point of being “ready for uptake” or showing “evidence of scaling.” REFS specialists analyzed these phase 3 and phase 4 innovations, assessing the innovations’ likely pathway to scale, supply or demand constraints, and initial reports about dissemination to try to learn the extent to which these innovations had achieved scale. Phase 4 innovations were examined to see if they were reaching end users directly or through diffusion, and for lessons learned from those innovations that had reached larger populations of farmers.

REFS and missions were committed to scaling the most promising of these innovations, through ongoing and new partnership platforms and by relevant programs and projects. Together they spearheaded a three-pronged approach to scaling these promising innovations:

- Linking promising products and services to potential partners through:

- Highlighting innovations at regional platforms including 13 high priority products at the Africa Food Systems Forum in a virtual showroom in September 2021 and innovation showcases in other venues, involving innovation developers, missions, and implementing partners.

- Brokering partnerships for selected products via the REFS Market Systems & Partnerships (MSP) project with participating missions and implementing partners.

- Limited direct support for pilot scaling efforts under REFS research mechanisms.

- Promoting RRU crop varieties in conjunction with Syngenta Foundation’s Seeds2B spin-off, the Seed Systems for Development Activity, and AGRA.

- Bundling agricultural practices strategically with prioritized products and services.

Additionally, selected practitioners identified systemic barriers that limit scaling of promising technologies and developed guidance to overcome key constraints (see the accompanying Addendum).

REFS investigated how intellectual property (IP) rights from research partners can be better supported, which suggested that licensing, trademarking, or patenting do not represent a hindrance to moving technologies off the shelf. Discussions among REFS and stakeholders interested in IP and its effect on scaling elicited a few themes. Scaling through the use of IP, e.g. patenting or trademarking, is expensive, particularly if the potential market goes beyond one or two countries. And only a limited set of technologies can garner the returns necessary to cover all legal and administrative costs associated with patenting, trademarking, and exercising Plant Breeders Rights. Second, absent specific efforts by the Innovation Labs and their university partners, the vast majority of technologies in the RRU could be widely scaled without legal–specifically IP–concerns. Third, for those technologies that are not viable for a purely commercial scaling process, partnering opportunities could facilitate wider distribution of technologies. For instance, Purdue’s Business School hosts the ‘Purdue Foundry’ that provides a business lens focused on entrepreneurship and the commercialization of Purdue-derived technologies to help them achieve commercial success. Technologies are assessed for potential market viability through workshops, feedback and a ground truthing process with students and staff.

1.6 Early Challenges and Findings in Monitoring and Systems Change

FTF implemented a rigorous monitoring, evaluation, and learning (MEL) framework to track progress at different levels, support evaluation and analysis, enable performance-based and adaptive management, and remain accountable to its commitments. This framework also sought to generate evidence on effective, evidence-based approaches to improving food security and nutrition. Through the MEL framework, FTF promoted a common set of standard indicators that served several purposes: monitoring activity performance, ensuring accountability, and measuring high level results and impacts at the activity, Zone of Influence, and national levels. The main challenge was designing indicators that could capture meaningful outcomes across a broad range of programming and align with FTF’s high level goals and objectives, while also minimizing the reporting burden for partners and USAID staff. See Appendix Two for an explanation of the types of data and information that were captured in FTF’s reporting system.

Tracking the scaling of innovations through the FTF Monitoring System proved challenging. While standard indicators existed for implementing partners and field staff to report on scaling efforts, they often reflected only a part of the story due to limitations in available data, timing, and geographic coverage of donor funded R&D activities.

Why is tracking diffusion of innovations so difficult?

Tracking the diffusion of innovations is inherently difficult because it serves multiple purposes — from accountability and reporting to adaptive management and learning — and each purpose may require different data, collected from different sources, over varying time periods and geographic areas.

At a minimum, monitoring of scaling seeks to answer:

- What innovations are being used?

- Where and by whom are they being used?

- To what extent has a particular intervention reached its potential market?

Beyond these basics, monitoring can capture the various phases and pathways of scaling across multiple levels — policy and enabling environment, systems, enterprises, and farmers/households. Measures may include:

- Estimates of total potential market

- Identification of market system constraints

- Critical mass of early adopters

- Profit/risk incentives for all actors in the value chain

- Risk and return for “average” users

- Adoption rates among direct and indirect beneficiaries

- Production, sales, and distribution data

- Progress toward commercial sustainability

- Relevant policies and subsidy regimes

- Access to and affordability of innovations, finance, spare parts, technical assistance, and extension support

Measuring scaling can also extend far beyond what implementing partners directly influence or what donor programs require for reporting. For example, assessing whether an innovation truly scaled may require data on widespread adoption at the population level, not just uptake by direct project beneficiaries.

Questions beyond what to measure

Tracking the effectiveness of scaling raises not only the question of what to measure, but also how to measure it, how often, from whom, and in what locations. In complex systems, it is rarely possible to claim direct causation, or credit, for scaling outcomes. Instead, “plausible association” — linking funding, investments, and partnerships to downstream outcomes — is often more realistic.

Contribution analysis offers one methodology for establishing these linkages. Rather than proving with certainty that an intervention caused specific changes, it builds an evidence-based narrative showing how and why these changes occurred. While randomized control trials (RCTs) are the gold standard for establishing causality, they are difficult to apply to innovation scaling “in the wild,” where multiple actors, market dynamics, spillovers, and the absence of a clean counterfactual complicate analysis.

Measurement challenges at different levels

At the farm level: Tracking the use of specific innovations, (e.g., crop varieties, services, fertilizers, and practices) at the individual farmer level is expensive. USAID invested in numerous innovations, which can be applied at different points in the production cycle, often in partial or mixed packages across different parts of a farm. This sheer variety can require a large sample frame and a complex survey instrument (potentially complemented by other methods, including visual confirmation, soil sampling or crop cuts). Visual verification works for some farming practices, like planting in rows or irrigation, but not others. Full adoption may be difficult to validate as farmers frequently adopt practices selectively and not as a package. The prevalence of counterfeit goods in some locations can distort results.

At the project level: Scaling takes a long time and often does not fit neatly into the typical donor five-year program cycle. By the time the innovation hits the field or is handed off to a scaling partner, project funding may have ended. The research partner may have “handed off” the innovation to another entity, including an NGO or a NARS, who may not have links to the donor. Ultimately, no entity is responsible for reporting on dissemination outcomes further downstream. Tracking adoption after project close-out, including outside intervention areas, is critical but rarely funded.

At the MSME level: SMEs may lack the resources or incentives to collect (and report on) customer and sales data. Many don’t recognize how data could improve profitability and customer support.

Opportunities for better tracking

- New, more cost-effective methods, including DNA fingerprinting, can accurately identify varieties in farmers’ fields. With prices lowering, this method is becoming more viable.

- There is strong justification for using digital technologies to track innovation diffusion. Remote sensing may be used for certain practices; offline data collection via mobile device in low-connectivity areas has become the norm; mobile-enabled extension through extension agents, village-based agents, or agrodealers can reach more farmers, faster, enabling innovations to make it into the field quicker than ever before and provide a digital footprint of who accessed information and when.

- Leveraging national agriculture censuses and surveys. : Engage with initiatives like the World Bank’s LSMS-ISA and 50 x 2030 initiatives to include innovation adoption questions that are of national and regional significance. The report, “Shining a Brighter Light: Comprehensive Evidence on Adoption and Diffusion of CGIAR-Related Innovations in Ethiopia,” describes the process and methodology where the collection of data on the diffusion of 18 agricultural innovations developed by the CGIAR were incorporated into the Ethiopian Socioeconomic survey, providing nationwide estimates on the reach of these 18 innovations. In this vein, FTF Innovation Labs’ innovations also passed through the hands of various scientists and research institutions, particularly the CGIAR since it acts as a bridging institution due to its inherent advantage of having more in-country presence.

- Leverage partnerships with other donors in the area, such as the Gates Foundation work on DNA fingerprinting.

- Support agri-MSMEs to collect, analyze, and use data on dissemination for those innovations that have a commercial pathway, including sales, distribution, transaction costs, and profitability. Demonstrate profitability gains from targeted growth strategies using a data-driven approach. For instance, knowing where sales are growing or where licenses are awarded would enable them to better target future growth opportunities.

1.7 Decade-long lessons

In 2013, REFS embarked on an initiative for USAID missions to develop scaling plans for scaling up innovations emerging from the Innovation Labs that would make a significant impact on food security in FTF target countries. Select practitioners identified innovations with high scaling potential that were already available for uptake, as well as new innovations developed by the FTF Innovation Labs and One CG partners. Three significant differences steered REFS’ approaches to scaling. First, REFS was guided by nearly a decade of learning, a comprehensive scalability assessment toolkit, and experience of applying these scaling approaches to real world applications. Second, REFS had instituted a rigorous Product Life Cycle approach to its agricultural research investments that integrated scaling criteria into stage gates. Finally, REFS’ implementing partners had also gained significant experience of scaling both innovative systems and technologies.

Lesson 1: Institute a Product Life Cycle for innovations — a system change

REFS launched the Product Life Cycle approach (PLC) in 2021 to drive improved diffusion of innovations and research investments by USAID and its partners. The PLC approach is an industry standard for product development, but for REFS, the PLC represented a novel approach to thinking about research investments and engaging research partners. The PLC embedded an increased emphasis on systems change, emphasizing both the technology scale potential as well as adoption potential. Designed with stage gates, the PLC guided R&D developers to consider a pathway to market for their innovation, including conducting market research, identifying and solving for barriers to adoption, and connecting with downstream partners along the technology’s trajectory development and scaling pathway. The PLC is intended to assist R&D developers in the journey to scale without requiring separate scaling programs for each innovation. The PLC was implemented through an iterative learning process that guided its further refinement.

Questions still being considered through the PLC rollout included:

- In what ways can the PLC stage gates and criteria be adapted to better support development and scaling of REFS-funded research investments, including better defining markets and possible business models?

- How can the PLC engage in product portfolio strategy and management to better serve local agribusinesses’ needs and capacity gaps? How can larger, capable firms leverage behavioral economics research to understand their supply chains, motivate suppliers/distributors/retailers, understand customer behaviors, and how to work with those when possible or shift them if necessary?

- What are the other enabling, or wrap-around supports required for adoption of the product by the end user? To what extent are those in place? How can market actors be motivated to provide them, if appropriate?

These questions will remain unanswered by USAID.

Lesson 2: Align strategic partners

Alignment of strategic partners is essential to defining appropriate and context specific technology bundles, including new innovations, for scale. REFS’ Scaling Team assessed country- and FTF Zone of Influence-level characteristics to alleviate constraints to scaling technology bundles that were best suited to maximize relevance and value. Individual Mission operating environments were unique and necessitated a customized technology ‘bundle’ of products and services aligned with distinct country-level attributes and constraints such as farming systems, agro-ecological zones, current and projected climate patterns, farmers’ sophistication, market institutional arrangements, readiness of private sector actors, level of host country government capacity, supply chain accessibility, and barriers to entry.

Short-listed technologies, practices and bundles suitable for the country and capable of overcoming country-specific constraints were presented to Missions. REFS and Mission staff held ongoing discussions to clarify contexts, priorities, constraints, and opportunities to ensure relevance of technologies. Following these discussions, REFS and missions engaged strategic partners with potential interest in tailored technology bundles to support USAID country programs. Washington-based technical experts, technology developers, agricultural officers, Mission staff and field-based implementing partners participated in informative presentations on country-specific technology baskets. One session was a virtual agriculture marketplace of Innovation Labs’ technologies for missions and their implementing partners to increase awareness of, and possibly broker, those innovations to potential market actors.

To further guide the uptake and diffusion of innovation baskets, REFS identified success stories that communicated lessons learned and informed best practices. These stories and lessons identified the critical efforts to most efficiently and effectively achieve diffusion at a wide scale. Success stories also provided a ‘proof of concept’ and reassured partners of the benefits realized when an innovation concept successfully scaled.

Lesson 3: Learn by looking back and looking forward

Across REFS, learning about the mechanics of scaling took diverse forms, including examination of programming, partners, innovations, literature, and building on earlier research. Driven by the main objective of disseminating productivity-enhancing innovations widely from its research investments, REFS focused on available levers, namely improving programming and technical assistance, including learning and analysis, leveraging relationships with different partners and the private sector, guiding the REFS-funded portfolio, and supporting missions.

The following learning questions were intended to advance the Bureau’s continued learning agenda about how to realize scaling success:

From a farmer’s perspective:

- To what extent do innovations address farmers’ expressed needs and priorities and what are the competing alternatives?

- To what extent can farmers access and afford the innovation, and what mechanisms reduce financial and adoption risks?

- To what extent can farmers easily integrate (i.e., plug & play) innovations into their existing farming systems and practices?

- To what extent do training, demonstrations, peer-to-peer learning, and marketing efforts build farmer trust and confidence in adopting and using innovations?

- To what extent is potentially increased production linked to markets that enable farmers to capture value from productivity gains?

- What does the return on investment of the innovation for producers or other users versus what they are using need to be to support adoption?

- To what extent can innovations better enhance inclusion (delivering benefits to women, youth, marginalized groups) and strengthen resilience to climate, pests, and market shocks?

From a market perspective:

- Which REFS-supported innovations, including technologies, practices, and approaches, that are ready to scale have the greatest likelihood to scale from a market perspective? And factors supporting scaling?

- What innovations have the potential to scale but need additional support to be more viable? What types of interventions can reduce these barriers and increase the “scalability” of these innovations?

- What are the pervasive gaps in country-level agriculture research and development systems that, if addressed, would facilitate successful transfer and delivery of innovation by market actors independent of donor support?

- What mechanisms are available to reduce real and perceived private sector investment risk in agricultural technologies funded by donors or governments?

From a landscape perspective:

- What are countries’ yield gaps in relation to their agroecological zones, and do they have a high potential to benefit from productivity enhancing innovations?

- What are the innovations that are most suitable for these regions? How can appropriate innovations be promoted in these areas? How do practitioners know, or how can they be sure, that specific innovations are best suited to particular eco-zones?

Measurement:

- What are the best methods, measures, and approaches to track diffusion of REFS-funded innovations and technologies to beneficiaries and beyond? What are the pros and cons of these different methods?

- To what extent have REFS-funded technologies and innovations been adopted and used by farmers? How can farmer benefits be quantified, including for women, youth, and marginalized groups?

- Can REFS determine whether a demand-driven and client-focused industrial research model yields higher returns on research for development investments than the traditional supply-driven academic model?

Lesson 4: Donors should incorporate learning into future research partnerships

REFS’ experience at the 2021 African Green Revolution Forum (now the Africa Food Systems Forum) underscored the importance of embedding scaling considerations into research from the outset. Innovation Labs, while not tasked with scaling outputs themselves, were expected to design research for scale, apply Product Life Cycle (PLC) stage gates to ensure readiness for uptake, and use feedback loops to improve design and facilitate hand-off to market actors. This experience showed that scaling requires more than good research—it requires continuous engagement with potential adopters, early partner linkages, and adaptive learning at each stage. Donors can strengthen this process by supporting researchers through convening, brokering, building institutional capacity, and influencing policy, ensuring that research partnerships are structured to move innovations smoothly from discovery to widespread use.

2.0 Prioritizing Commercial Pathways (2020–2024)

2.1 Aim of Section 2.0

Diffusion of innovations through commercialization is an attractive prospect as a hand-off to a commercial partner could lead to positive outcomes for farmers and the commercial partner. As users adopt the technology, more energy can be devoted to marketing the technology and extending its reach and impact through the sharing of application-specific success stories and field-based results.

The following key findings provide entry points for helping innovators scale their innovations on a commercial pathway.

There are two important framing points to consider. As referenced in Section 1.0, there are a number of pathways to scale, including public and public-private partnership (PPP) pathways. The work discussed in this section generally focuses on a commercial pathway to scale. Technologies that may be better suited to a public or PPP pathway still have use and are crucial to development impact, but they are not emphasized here. Second, there are many possible methods and tools for R&D management. The Product Lifecycle (PLC) is one approach, which USAID deployed to improve its agricultural research and development pipeline. The innovations discussed here are research outputs that have been classified as “ready for uptake.”

Important learning points include:

- Business models need to be developed early in the R&D process: A business model identifies the products or services the business intends to sell, how it will sell its products or services, inputs suppliers and output buyers, its identified target market, and any anticipated expenses. Innovation developers (or another stakeholder) need to consider what business model will most effectively scale their innovation (or where), e.g. direct sales, franchising via village agents, etc.

- Data is lacking: Economic information on innovations coming out of the R&D phase tends to be incomplete (e.g., for fixed/variable costs, suggested pricing, potential revenue) and this lack of data can limit market interest.

- Strengthening marketing channels alone is not sufficient: Promoting innovations through marketing channels like events, digital platforms, and hands-on brokering can be costly and insufficient for achieving desired results. Practitioners should seek to facilitate the pull of innovations by potential users – i.e., strategically matching the innovation to likely market demand.

- Consider complementary technologies or information that will boost farmer profitability: Utilization of technology bundles is not yet robust, which limits adoption and returns to the farmer.

- Institutional arrangements can be the difference between successful or failed markets for innovation delivery at scale. Factors for successful market arrangements are rules (legal framework), roles (clear division of responsibilities), resources (sustainable financing), relationships (trust, accountability, and dispute resolution), and resilience (capacity to adapt).

- New focus, skills, and experience are needed: Transitioning from academic research (discovery) to the delivery of market-led solutions requires different skill sets. Technology developers may not know how to develop business plans, assess markets, and maximize outcomes for farmers.

The discussion below describes the process followed to reach these conclusions, ending in a proposal for next steps.

2.2 Key Findings & Strategic Recommendations

This section distills lessons from 2020-2024 efforts to transition agricultural innovations from research to commercial adoption. While recognizing the value of public and PPP pathways, the focus is on commercial scaling, where viable business models, robust economic data, and effective marketing channels are essential to success.

Key Findings – linked to learning points above

- Business Models Drive Scale: The choice of business model must align with the innovation, market size, and target customers. Partners including agrodealers, business service providers (BSPs), business to business (B2B) relationships, fabricators, cooperatives, and licensing arrangements each offer distinct advantages and limitations. Early alignment of business models within the Product Life Cycle (PLC) research process enables more strategic commercialization.

- Economic Analysis is Critical: Investors and adopters require clear cost-benefit data, including production costs, pricing, return on investment (ROI), and market size. Standardized economic data templates would improve readiness for investor engagement and digital platform dissemination.

- Delivery Channels Matter: Effective scaling depends on reaching users through appropriate delivery networks such as agrodealers, BSPs, co-ops, fabricators, B2B actors, distributors, and digital platforms. Demonstrations, trade shows, and strategic partnerships enhance credibility and reach.

- Showcasing Works–With Preparation: Virtual and in-person showcases generate interest but only succeed when supported by investor-ready materials with specific pricing, distribution, and performance data.

- Brokering & Partnerships Accelerate Uptake: Strategic matchmaking between innovators, investors, and distributors–supported by tailored technical assistance–can bridge the gap from demonstration to adoption. Partnerships with organizations like Peace Corps, Syngenta Foundation’s Seeds2B, and the African Seed Trade Association illustrate scalable models.

- Communication Strategies Need Embedding: Early development of sell sheets and prospectuses-tailored to specific audiences-improves visibility and credibility. These should be budgeted and planned from the start of R&D.

Recommendations

Summarizing strategic recommendations from these four years for scaling practitioners:

- Embed business model planning, economic analysis, and communications development into early research stages.

- Standardize economic data collection to meet user, investor and platform requirements.

- Use targeted delivery channels and events for strategic partner engagement.

- Institutionalize brokering functions that link innovations to commercialization partners.

- Leverage appropriate digital platforms and strategic partnerships for sustained diffusion.

By institutionalizing these practices, scaling practitioners can strengthen the bridge between innovation and impact, ensuring that research outputs reach farmers and markets at the scale and speed required to drive food security, resilience, and income growth.

2.3 Deep Dives: Scaling Feed the Future Research Investments, an Experimental Approach

Until its discontinuation, Feed the Future’s innovation environment was one in which research investments were faced with a supply problem. Until its discontinuation, Feed the Future’s innovation environment was one in which research investments were faced with a supply problem. Research investments were driven at a very high level by the objectives of Feed the Future so investments were developed to support agriculture-led economic growth, nutrition, and resilience, but too often were not, from the earliest stages of development, connected to rigorous economic and financial analysis or an understanding of potential demand, underpinned by viable business and delivery models, and engaged with appropriate channels for dissemination. The most obvious way that this supply-driven challenge manifested itself was through data collected for the Research Rack Up (RRU) ( please refer to Section 1.4 ). Many innovations were developed and reported in the RRU. However, there was limited evidence of widespread scaling of these innovations, demonstrating a clear opportunity to better understand the constraints that could prevent smallholder farmers from using them and getting their benefits, including increased productivity, nutrition, income, and resilience, among others. Low levels of uptake were seen across all scaling pathways, commercial, public, and PPP.

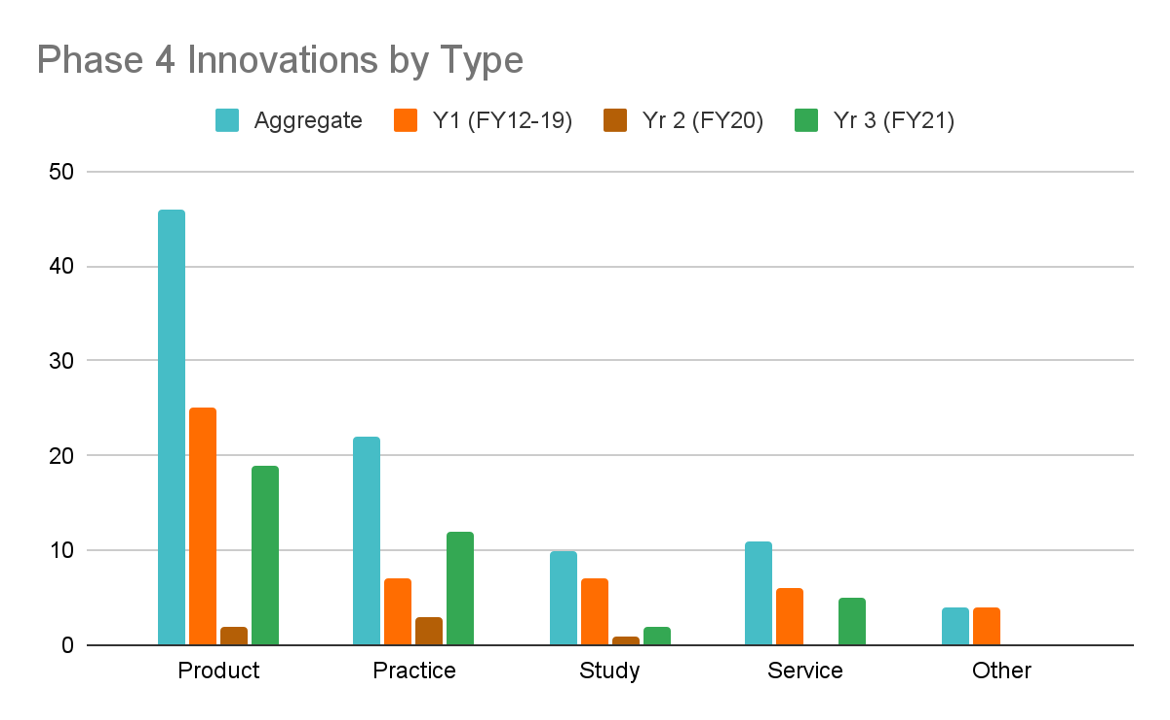

As can be seen in the chart below, very few innovations – less than 50 for each type of innovation – moved into Phase 4 (Demonstrated uptake by the public and/or private sector) as defined by the FTF Indicator EG.3.2-7: Number of technologies, practices, and approaches under various phases of research, development, and uptake as a result of USG assistance.

REFS intended to address the supply problem for innovations in the research pipeline with the full roll out of the PLC, by integrating demand and market considerations into each phase of research and stage gate.

Meanwhile, REFS focused on demand-driven approaches to connect existing research innovations, sitting “on the shelf”, with a potential market(s). Using a variety of methods, REFS’ scaling team identified and connected existing, viable innovations with potential investors or markets – in other words, connecting them to demand. These methods took a variety of forms discussed below. What underpins each method is the alignment of incentives and interests between businesses, investors, and the solution the innovations provide. In line with general scaling theory, such innovations should display a relative advantage to existing innovations, be trialable, compatible, observable, and with their degree of complexity considered.

Brokering Efforts

The scaling team engaged the FTF Market Systems and Partnerships program (MSP) with the goal of identifying 3-4 innovations with good potential to reach an intended market and then move those forward on the path to commercialization. The work occurred in two phases: Phase 1 to filter and select the innovations for brokering support; and Phase 2 to facilitate partnerships to scale these innovations and to develop a pipeline of potential investment opportunities and relationships. Phase 1 was completed in 2022, and Phase 2 in 2023.

In Phase 1, consultants developed selection criteria to filter and review a total of 35 promising innovations. They ultimately selected two – the Multi-Crop Thresher and the GrainMate Moisture Meter – to receive scaling support. A Learning Memo documented the process that the MSP team undertook to filter and select the innovations that would move forward into Phase 2 and what challenges they faced to complete this process.

During Phase 2, MSP facilitated the arrangement of partnerships and investment opportunities for the innovations (or the businesses behind them, depending on the situation). One of the key outcomes of this work was the necessity of identifying a business model and delivery channel from the earliest stages of innovation development.

Business Models

A business model is a company’s plan for making a profit. It identifies the products or services the business intends to sell, its identified target market, market actors that engage with the innovation, and anticipated expenses. A business model describes not just what benefits the innovation will bring but how the benefits will be delivered. An innovation needs a viable business model that includes the right data so inventors and investors can track expenses, income, and the breakeven point. Business models also need information about potential markets. The choice of business model will determine how an innovation scales through commercial pathways and needs to be appropriately matched with the innovation. The wrong business model for an innovation will not scale. As discussed in Section 1.0, scaling up products and services as private goods means they are subject to demand-pull forces by markets.

Business models engaging different market actors, and their related functions in FTF programs include the following:

- Agrodealers are generally physical stalls or stores that sell agricultural inputs, farm implements and can also provide technical advice. There are several categories of agrodealers including hub agrodealers, which service other agrodealers and large commercial farmers, agrodealers that just supply farmers, and village-based advisors if they sell inputs directly or on commission. Agrodealers often operate in networks where hub agrodealers supply smaller dealerships, which in turn may supply smaller dealerships and so on. Agrodealers are often key links for reaching smallholder farmers with improved products and services from Innovation Labs, such as new crop varieties sold by seed companies through these venues.

- Business service providers (BSPs) manage and operate standardized business processes on behalf of its customers and delivers its service to multiple customers, often using a “pay as you go” payment model. BSPs typically provide functional services (usually mechanized) to farmers or farmer groups, such as maize shellers, tractor operators, maize dryers, etc. Examples of BSP models that have taken up Innovation Lab technologies include Hello Tractor’s digital app for plowing and other services provided by tractors and the Soy Innovation Lab’s (SIL) multicrop thresher.

- Business to Business (B2B) is a type of commercial transaction between businesses where one business provides products and/or services to another business; examples include the manufacture of early generation seeds for seed companies and equipment for processors, such as is done by Seeds2B. A specific Feed the Future example is the drying beads developed with support of the Horticulture Innovation Lab. The drying beads, which draw out moisture from their surroundings, were deployed through a B2B model in Bangladesh where seed companies use them to dry their seeds prior to conditioning and onward sales. Farmers are the downstream beneficiaries of higher quality seeds, but the seed business model does not include the drying beads. Other B2B examples from the Innovation Labs include Sesi Technologies’ moisture meter in Ghana and the Post Harvest Innovation Lab’s BAU-STR rice dryer in Bangladesh. Hub agrodealers may be exclusively a B2B model if they only supply smaller agrodealers.

- Fabricators make things by combining or assembling diverse, typically standardized parts, usually copying products or designs. Multicrop threshers, Dry Cards, portable solar dryers and evaporative cooling (clay pot) technologies are all Innovation Lab examples of technologies that can be made locally by easily obtained materials .

- Associations and Cooperatives are groups of farmers, businesses, or other organizations with a common purpose under a formal structure, which are often owned and run jointly by members, who share the profits or benefits. Farmers join together in many types of groups such as water user management associations, seed banks, and marketing agents. These farmer organizations often provide services to farmers including plowing, planting, crop management, harvesting, and aggregation. Each of these services can be made more efficient by the application of technology so that, for example, plowing or planting across members’ farm plots is much more efficient using tractors and their accessories.

- Under Distributor–license agreements, the business owner, the licensor, grants a licensee the right to use the licensor’s intellectual property. Under a distributorship the Licensee is responsible for any manufacturing. The Partnering for Innovation program facilitated such a relationship with Bell Industries to manufacture PICS bags in Kenya using Purdue’s trademark.

With REFS’ migration to a PLC research management system, the development of a business model for each innovation was set at Stage 1. Once a research question and potential solutions or innovations have been identified to address the target population’s needs, business model planning should be undertaken as the next step in the process. In the case of a new crop variety, farmers are facing low yields, new pests and diseases, and a shortened growing season. Researchers may define the question as how to maximize yields for a 100-day season with certain pest and disease resistance characteristics, and high protein or other nutrients. There is a potential adopter population of several million farmers in the region. For successful scaling, certain business model elements must be planned in advance such as: how will the variety be licensed, and exclusively or non-exclusively; how will the variety generate a profit for a seed company, a brewer or a miller; what network will multiply, deliver, and train intermediaries and users on this variety. These questions, at a minimum, are relevant at this early planning stage as it influences who trials the variety and where, how much farmers are willing to pay, or if hand-off to a value chain anchor (e.g., a brewer) will be a better strategy. These decisions are even more pertinent for complex innovations. REFS found that one thresher was preferred over another for its transportability, even though the first thresher was more versatile in the field. The stage gate checks designed into the PLC forces researchers to address such questions several times throughout the cycle.

The choice of business model strongly influences the delivery channels that are most suitable to reach potential users downstream. Some innovations may be amenable to more than one channel, depending on the business model. For example, the Dry Card could reach users through several channels including agrodealer networks, associations and cooperatives, and even via multi-national corporations for selected cash crops. In most cases, though, the choice of business model limits the innovation to a single channel. For example, the solar vegetable dryer in Senegal, discussed in the RODS Report, uses a single-manufacturer business model which defined the market as vegetable processors who export their products to Europe. The size of this market turned out to be tiny, and the majority of exporters were uninterested in this dryer. However, the planned business model could have instead used a BSP model with a mobile dryer that could serve numerous villages, and the market could have been in the thousands, and more sustainable, because of the market’s size and the technology’s mobility. In both of these examples the business model, driven by the definition of the target market, determined the viability of channel options that were available.

When determining what type of business model works best for scaling up an innovation, some important questions should be considered:

- What problem does the innovation solve, and how large is the potential market for the solution?

- What is the competitive landscape, and how does the innovation compare to existing solutions?

- What is the most effective way to monetize the innovation, and what pricing model should be used?

- How will the innovation be distributed or sold to customers, and what partnerships or channels will be used?

- How will information and training about the innovation be conveyed to intermediaries and end users?

- What are the costs associated with scaling up the innovation, who are the different stakeholders involved in the manufacturing, multiplication, and selling, and what funding sources are available?

- What are the regulatory requirements, if any, for bringing the innovation to market, and how can these be navigated?

- What is the best organizational structure for scaling up the innovation, and what talent is needed to execute the strategy?

- How can data and analytics be leveraged to optimize the business model and improve the innovation over time?

Answering these questions can help identify the most viable business model for scaling up the innovation, as well as potential roadblocks and areas that may require additional research or development. Ultimately, the goal is to create a sustainable and profitable business model that effectively brings the innovation to market and meets the needs of customers.

Economic Analysis

The economic analysis of an innovation, elements of which feed into the business model, must provide estimates of potential market size and the suggested selling price. Price will vary by location, but the cost composition should be itemized and comprehensive.

Many innovations in the RRU lacked detailed economic analysis, particularly from the perspective of manufacturers and distributors. While there were some basic cost estimates for end-users, they were often incomplete or failed to account for ongoing operating expenses. Few studies capture the full cost structures associated with production and distribution, leaving innovators and partners without a clear picture of what is required to scale. Market size estimates and the costs of last-mile distribution are especially underexplored, even though they are essential for demonstrating profitability and ensuring sustainable delivery.

Economic analysis encompasses four areas of concern for potential technology investors. Investors want to know the fixed and variable costs of producing a technology, the suggested price, the prospective revenue with an eye toward the breakeven point, and the economics of the business model through which a technology might scale. Most investors are interested in businesses that will scale a technology versus scaling a technology by themselves. Additionally potential innovation users, whether market intermediaries or farmers, require specific cost and benefit information in order to make an informed uptake decision, which feeds into demand projections.

Economic data is sought not just by investors and adopters but also by hosts of digital innovation portals, now much in use, such as the Technologies for African Agricultural Transformation (TAAT) Clearinghouse. These hosts seek to elevate awareness of innovations by increasing their dissemination to a broad range of potential adopters and can serve as delivery channels in the context of donor projects. The innovation portals all require specific economic data related to the innovations, each in its own format. Although the economic data that portals need vary slightly, data requirements tend to be similar standardized economic data. As an example, the TAAT Clearinghouse template requires economic data including initial cost, operational cost, return on investment, and economic advantage (cost savings, improved efficiency) prior to upload into the digital catalog.

In short, closing these data gaps is vital for building the case for investment, guiding design and distribution strategies, and enabling adoption at scale. Without strong evidence on comparative performance, customer benefits, and economic viability, innovations risk stalling before they achieve meaningful impact.

Delivery Channels

Data Needs and GapsAssessing the potential of an innovation requires reliable and comprehensive data. Without it, both investors and end-users face uncertainty that can slow adoption and reduce the chances of scaling. Three categories of data are particularly important: the competitive landscape, customer segmentation, and the economics of adoption. Competitive landscape data provide the context needed to understand the potential value of an innovation. This includes identifying existing products, their suppliers, and traditional practices that already serve the target market. Establishing baseline metrics, such as yield levels, efficiency rates, or the costs of current practices, allows for a clear comparison of benefits. At the same time, analyzing the cost and performance of competing technologies helps position an innovation’s unique advantages in terms of efficiency, affordability, or other value propositions. Customer segmentation data are equally important, since different groups along the innovation pathway will experience costs and benefits differently. Investors are interested in potential returns, while manufacturers and distributors focus on margins, risk, and scalability. End-users, by contrast, are primarily concerned with affordability, ease of use, and the potential for savings or income gains. Understanding how adoption impacts each group is critical for designing incentives, aligning interests, and ensuring market uptake. Economic data form the foundation for even the most basic analysis of adoption potential. For end-users, this requires estimates of the initial cost of adoption, ongoing operating costs, and the expected savings or profits associated with use of the innovation. For manufacturers and distributors, data are needed on equipment, facilities, and licensing, as well as the labor and material costs required to bring an innovation to market. Additional costs for transport, marketing, and last-mile distribution determine not only the price passed on to the end-user but also the minimum selling price necessary for profitability. At the broader market level, demand estimates and competitor pricing data—such as those available through resources like the Engineering for Change Solutions Library or the FAO Sustainable Agricultural Mechanization Database—help frame the overall economic landscape. |

A key objective of REFS’ scaling team was to identify delivery channels to reach potential adopters and investors for these innovations. Delivery channels, in the context of reaching beneficiaries with new innovations, are the people, organizations, and processes that engage in functions to transfer new technologies from the point of introduction (e.g. registration, manufacture, etc.) to the point of uptake by end users. Delivery, or market, channels are the way in which new innovations reach the intended users and comprise supply-chain segments, or functions, including producers and suppliers, distributors and intermediaries, information providers, consumers and end-users, and the financial intermediaries that underwrite most of these supply-chain segments. Delivery channels and their actors should also be included in the business plan, as it factors into the business model, income, and expenses.

Findings related to delivery channels, FTF Innovation Labs and implementing partners, certain business models, and market actors are described below.

- Hub Agrodealers: Innovation Labs and other implementing partners are only able to reach agrodealers indirectly for the most part. Most agrodealers are too small or too remote to work with implementing partners. The best channels for an Innovation Lab to reach agrodealer networks are via hub agrodealers, agriculture inputs companies, farmer demonstration events, or industry associations. A majority of the product innovations developed by FTF Innovation Labs would likely have reached farmers through agrodealer channels if they were linked up with these market actors.

- BSP networks: The value of agricultural technologies generated by the Innovation Labs must be evident both to potential BSPs and to the farmers who stand to benefit from the associated services. Reaching BSP channels with relevant innovations is not straightforward. Farmer demonstrations are the most prevalent opportunity for showing farmers the usefulness of agricultural inputs and equipment, but BSPs don’t always attend these events. A more likely channel is via hub agrodealers, many of whom have showrooms. Implementing partners may be the most direct channel to hub agrodealers; however, such agrodealers are unlikely to showcase new equipment for service providers based on a single model or a set of designs fresh from research trials.

- Fabricators: Fabricators have proven very difficult to reach. Fabricators are oftentimes small in size and operate informally, providing services to a specific geographic area. Fabricators generally use locally-procured materials (wood, scrap metal) as the primary inputs to their final products which are supplied to smallholder and cooperative customers. Innovations using locally sourced materials have the potential to be widespread and affordable. There are many open-source blueprints, specifications, and plans for technologies that could be of high value to fabricators and their customer base, but channeling these plans to fabricators has been challenging. Examples of such plans included a chimney solar dryer, a pallet dryer, and a pot-in-pot evaporative cooling system. Identifying and locating these micro and small enterprises will remain a challenge for those seeking to disseminate improved designs and plans.

- B2B networks: Channels to B2B networks can be easier to reach directly as these partners are situated more centrally in value chains and are familiar to many donors, INGO, and implementing partners. Investor channels to B2B entrepreneurs are often direct as well.

- Associations and Cooperatives: These entities often arrange business services, demonstrations, and other learning opportunities for farmers. Where present, they may be one of the best conduits to reach smallholder farmers directly with innovations. Cooperatives in northern Mozambique, for example, have successfully introduced farmers to soybean production systems including new varieties, equipment, and inoculants.

- Distributorships and Licensees: Many of the Innovation Labs’ technologies can be categorized as bottom-of-the-pyramid technologies and not of much interest to university technology transfer departments. REFS found no examples of universities patenting Innovation Lab technologies. Opportunities for licensing and trademarking innovations vary considerably by innovation, yet downstream beneficiaries have expressed interest in obtaining licenses because their potential investors and lenders may require such arrangements.

REFS’ implementing partners did not observe some types of delivery channels that are prevalent in sophisticated markets, such as direct-to-consumer channels, joint ventures, crowdfunding, etc.

The matrix below shows how market actors can be reached by innovation developers by type of business model and market actor, indicating if the channel is a direct or an indirect medium, where commercial applications are possible:

Business Model/Market Actor |

||||||