[vc_row gap=”10″][vc_column width=”5/6″][vc_column_text css=”.vc_custom_1747924224336{margin-top: 0px !important;}”]

Preface

The Scaling Community of Practice (SCoP) launched an action research initiative on mainstreaming scaling in funder organizations in January 2023. This initiative has three purposes: to inform the SCoP members and the wider development community of the current state of support for and operationalization of scaling in a broad range of development funding agencies; to draw lessons for future efforts to mainstream the scaling agenda in the development funding community; and to promote more effective funder support for scaling by stakeholders in developing countries. (For further details about the Mainstreaming Initiative, see the Concept Note on the SCoP website).

The Mainstreaming Initiative is jointly supported by Agence Française de Développement (AFD) and the SCoP. The study team consists of Richard Kohl (Lead Consultant and Project Co-Leader), Johannes Linn (Co-Chair of the SCoP and Project Co-Leader), Larry Cooley (Co-Chair of the SCoP), Charlotte Coogan (Program Manager of the SCoP) and Ezgi Yilmaz (Junior Consultant). MSI staff provide administrative and communications support, in particular Leah Sly and Gaby Montalvo.

The principal component of this research is a set of case studies of the efforts to mainstream scaling by selected funder organizations. These studies explore the extent and manner in which scaling has been mainstreamed, and the major drivers and obstacles. The case studies also aim to derive lessons to be learned from each donor’s experience, and, where they exist, their plans and/or recommendations for further strengthening the scaling focus.

The present case study focuses on IDB Lab. It was prepared by Maria Elena Nawar, independent advisor and coach, and Sergio Navajas, Senior Specialist at IDB Lab. An earlier version of this study was commissioned by IDB Lab and executed by Imago, as part of an internally led learning exercise to support the development of IDB Lab’s strategic directions and to contribute to the SCoP’s Mainstreaming Initiative

Acknowledgements

The authors wish to thank Marcelo Cabrol, Ruben Doboin, Oscar Farfan, Dora Moscoso, Yuri Soares, and Maria Claudia Ventocilla from IDB Lab and Isabel Guerrero and Johanan Rivera from Imago Global Grassroots. Any errors or fact or interpretation in this report are entirely those of the authors.

Abstract

IDB Lab’s journey to scale innovation for development impact has been one of intentional evolution, rooted in learning, adaptation, and growing strategic clarity. From its origins as a fund supporting demonstration effects, IDB Lab has progressively built a more structured and data-informed approach to identifying, financing, and scaling early-stage solutions that benefit vulnerable populations in Latin America and the Caribbean. The third donor replenishment marked a turning point, formally elevating scale as a strategic priority and catalyzing the refinement of tools, metrics, and internal capacities. These efforts have translated into meaningful results, with the share of closed projects that successfully scaled rising from 17% in 2016 to 48% in 2023.

What sets IDB Lab apart is its unique ability to blend innovation with field-based intermediation. Staff play a proactive role in connecting high-potential initiatives with expert support, additional capital, and strategic partnerships—including within the broader Inter-American Development Bank Group. The 2022 in-depth analysis confirmed that the most successful projects shared common traits: capable and committed implementing partners, adequate financing, and strong alignment with IDB Lab’s mission. Recent advances in tools such as iDelta and the Innovation Results Framework have improved the way scaling pathways are assessed and tracked—during design, implementation, and even after project completion.

With the most recent replenishment approved in 2024, IDB Lab is well-positioned to consolidate its progress and deepen its development impact. Enhanced data systems, a clearer framework for scaling, and new approaches such as ecosystem-building and programmatic funding offer strong foundations for the future. As IDB Lab continues to support innovations that address complex challenges—from digital inclusion to climate resilience—it is building not only scalable solutions but also a robust institutional model for how development organizations can enable lasting change at scale.[/vc_column_text][vc_toggle title=”CLICK HERE TO READ MORE” icon=”0″ icon_closed=”0″]

Introduction and Purpose of This Study

In the economic and social development field, reaching scale is paramount yet often elusive. Many times, scaling up is confounded with concepts such as growth and sustainability of project results or the organization. IDB Lab recently adopted a corporate definition of scaling up from the Scaling-Up Community of Practice (CoP) which describes scaling up in relation to the magnitude of the problem being addressed. The definition is as follows: A systematic process leading to sustainable impact affecting a large and increasing proportion of the relevant need. Reaching this goal is often confronted with many obstacles. A prevailing culture of project approvals and disbursements within funding entities stymies the planning required during project design and implementation to achieve scale. Overly ambitious goals with unrealistic time frames sought by donor organizations do not allow project results to fully materialize and demonstrate proof of concept. This has led to prematurely declaring a project or initiative a failure and curtailing follow-up funding and additional time before knowing for sure whether it has the potential to scale and resolve a pressing development problem. Finally, implementation capacity, overlooked risks, and faulty analysis of the problem can all impede reaching successful outcomes and scale. IDB Lab, the innovation laboratory of the InterAmerican Development Bank (IDB), has faced all of these challenges. Yet, IDB Lab has had a relatively high level of success scaling its projects.

This case study aims to relay and unpack the evolution of IDB Lab’s approach to scaling from its founding to the present. The case study highlights 1) distinct organizational stages and corresponding scaling conceptual frameworks and key events that triggered changes in its scaling approach, 2) the current state of scaling and its plans to improve its scaling mechanisms so they can be mainstreamed within IDB Lab and extended to other areas of the IDB Group, and 3) lessons learned and challenges ahead. The case study was developed by conducting a desk review of institutional documents, presentations to IDB Lab Donors Committee, and internal and external assessments of IDB Lab’s scaling capacity.

IDB’s Scaling Journey: From Early Beginnings to The Present

IDB Lab is part of the Inter-American Development Bank Group, the leading source of development finance for Latin America and the Caribbean. It helps to improve lives by providing financial solutions and development know-how to public and private sector clients. The Group comprises the IDB, which has worked with governments for 60 years; IDB Invest, which serves the private sector; and IDB Lab, which tests innovative approaches to enable more inclusive growth.

IDB Lab’s Purpose

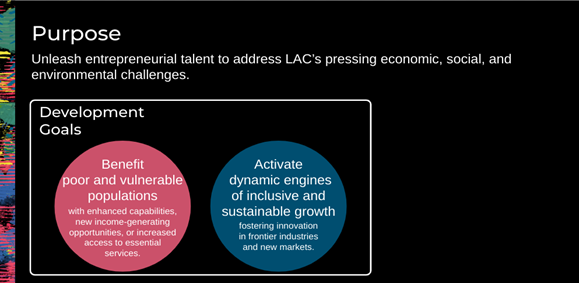

IDB Lab is the main window through which the IDB Group supports private sector innovation through grants, loans, and equity investments to firms and other entities in Latin America and the Caribbean (LAC) to support innovations and provide economic opportunities for poor and vulnerable populations. IDB Lab seeks to unleash entrepreneurial talent to address LAC’s pressing economic, social, and environmental challenges. Its two over-arching goals are to: 1) benefit poor and vulnerable populations with enhanced capabilities, new income-generating opportunities, or increased access to essential services and 2) activate dynamic engines of inclusive and sustainable growth by fostering innovation in frontier industries and new markets. (see Figure 1) Scaling up is central to IDB Lab’s mission as it acknowledges the explicit need to confront the obstacles between successful innovations and solutions to the region’s population-level problems.

Figure 1. IDB Lab’s Purpose

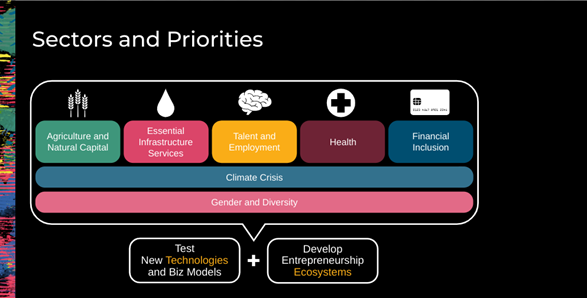

IDB Lab projects support five thematic verticals and two priority areas (see Figure 2) and provide financing directly to local partners in the region to test new technologies or business models. Partners include start-ups, NGOs, social enterprises, and/or key ecosystem actors such as incubators, company builders, investment funds, or other financing entities that seek to strengthen the entrepreneurial ecosystem.

Figure 2: IDB Lab’s Sectors and Priorities

During the 30-plus years since its founding, IDB Lab’s funding priorities and financing strategies have evolved. This is also the case with its approach to reaching scale. Since it is a testing ground for innovative development approaches, the financing IDB Lab provides to its partners is quite small relative to the financing provided by IDB and IDB Invest. IDB Lab financing ranges between $150 thousand to $2 million while IDB loan financing ranges from $10 million to $100 million for projects much larger in scope and of longer duration. Nevertheless, from the beginning, despite the experimental nature of IDB Lab projects, scale was always a desired outcome.

IDB Lab was established in 1992 as the Multilateral Investment Fund (MIF) with $500 million from the US government as part of the Enterprise for the Americas, an ambitious and wide-ranging hemispheric economic and trade integration initiative under President George W. Bush. The US provided the resources to the IDB to set up a fund to provide grant resources to facilitate trade, support human resource development, and strengthen micro, small and medium enterprises in the region. Soon after the US’s commitment was allocated, the Japanese government contributed another $500 million providing the MIF with a significant non-sovereign and concessional financing envelope. The MIF had its own governing board, the Donors Committee – separate from the IDB and the Inter-American Investment Corporation (IIC), now IDB Invest. The Donors Committee oversees strategic decision-making and approves operations. Equipped with a significant amount of capital for private sector projects, a dedicated governing board, and a mandate to be highly innovative and agile, the MIF began by operating independently of the IDB and IIC so as not to be encumbered by the bureaucracy of the sovereign financing side of the Bank. This independent operational approach lasted until 2017 when the IDB Group’s leadership saw an opportunity to improve coordination across the IDB, IIC, and MIF to enhance its outreach to its clients. Internally the lack of coordination between the three financing windows was creating inefficiencies due to duplication of efforts and missed opportunities for synergies through co-financing arrangements or sequenced financing. In 2017, the IIC became IDB Invest, and the MIF became IDB Lab the following year. The new branding signaled that the three financing arms belonged to the IDB Group and created an expectation that operations and coordination among the three would be more streamlined and efficient for clients. Internally, after many years of operating independently, IDB Lab began to make very concerted efforts during project design and implementation to improve collaboration and identify opportunities for follow-on financing through IDB and IDB Invest to scale its results.

IDB Lab’s Scaling Approach: Five distinct eras

The evolution of IDB Lab’s operational approach to scaling is reflected in 5 distinct eras of the organization’s history.

Figure 3. IDB Lab’s Scaling Approach

Demonstration Effect (1993-2006)

During the MIF’s first era, the ambitious spirit of the Enterprise for the Americas was reflected in the goals defined in its projects. The theory of change of its operations cited the demonstration effect of project results as a means to trigger lasting impact and scale. Given its independent operating approach, MIF targeted external scalers rather than seeking coordination with the IDB or the IIC. The more ambitious projects believed scaling would simply be achieved by effectively communicating the results of successful projects to affect public policy change and/or uptake from government ministries. In the early years, the MIF’s organizational structure comprised two main areas: 1) project design and implementation and 2) administrative/corporate matters. As time went on, the MIF gradually ramped up project approvals and expanded its focus areas to reflect the region’s changing needs. Operationally, the MIF deepened its efforts on improving project results and sustainability, and communicating results to boost the demonstration effect and thus scaling. Along with these changes, the number of staff increased. During this period – despite having a larger staff and significant resources – there was no operating definition of scale, a method for measuring scale, nor guidelines for developing scaling plans during project design and implementation.

Findings from OVE’s First Corporate Evaluation

The end of this period also marked a need to replenish its funds since 70% of the allocations were in the form of grants. In preparation for the request for additional funding from its Donors Committee, the Office of Evaluation (OVE) conducted the first evaluation of the MIF’s performance from 1993 to 2004. The evaluation found that the MIF’s operations were relevant, and its activities most successful when they reached a critical mass of resources in the same line of action as opposed to being spread too thin across initiatives. Replicating and scaling, however, remained a challenge. The evaluation suggested that the MIF’s key comparative advantages included its exclusive focus on private sector development, its focus on innovation, its tolerance for failure, and its network of key institutions. The evaluation highlighted several strategic and operational opportunities for improvement. However, none of the challenges and corresponding recommendations specifically referred to the topic of scaling. At the operational level, the MIF was advised to improve project implementation, risk identification including executing unit capabilities, and strengthen monitoring and evaluation which are important underpinnings for successful scaling. The MIF addressed these recommendations by developing new procedures and services for its clients to be implemented during project design and implementation. A funding replenishment process concluded in 2007 providing another $500 million in fresh resources for grant projects, loans, and equity financing.

Development Effectiveness (2007 – 2015)

The new injection of resources – albeit only half of the original tranche of MIF 1— allowed the MIF to continue innovating in more topic areas and bolster its ability to provide more services to its clients to improve project implementation, risk analysis, and monitoring and evaluation. As a result, the staff continued to grow and the organizational structure expanded to include units responsible for communications, development of knowledge products, evaluations, and development effectiveness. Although not explicit, the suite of new products and services was aimed indirectly at improving the client organizations’ capacity to scale in addition to improving implementation. Specifically, project design requirements began to include communication plans, development of knowledge products, and sustainability plans. Again, because scaling was an implicit goal, IDB Lab still had no working definition of scale, or instruments for measuring scale, nor was there any reporting on which projects scaled during implementation or after they had concluded. Therefore, staff and client organizations navigated the scaling process with little guidance. Despite limited guidance, a good number of MIF staff in the field who supervised project implementation and provided support to local partners found ways to tap into the MIF’s network of partners across the 26 countries to identify entities seeking to expand and/or replicate successful projects. The MIF’s extensive network of partners and thought leaders were also tapped to provide implementing partners with advisory support. This type of intermediation, however, was more opportunistic as it was not performed across all countries nor done systematically.

The MIF also began to invest quite heavily in impact evaluations and conducted randomized control trials (RCT) when possible. Impact evaluations were financed with public sector scalers (ministries) and IDB colleagues in mind to provide more compelling evidence on MIF project effectiveness as a means for broader uptake. However, the investments in evaluations did not yield the desired scaling outcomes. That is, findings from impact evaluations did not lead to follow on sovereign funding from the IDB or induce private sector scalers to expand or replicate. Ultimately, the MIF stopped financing impact evaluations because they were too costly and not fit-for-purpose. There were multiple reasons for this decision. On occasion, the costs of the evaluations were greater than or comprised a significant portion of the total project budgets. The experimental nature of the projects – which often require adjustments during implementation – did not align with the need for the intervention to remain static for the duration of the implementation period, altering the treatment and weakening internal validity. Executing agency measurement capacity was often lacking, hampering the effective capture of quality evaluation data. The MIF staff from the development effectiveness unit had limited capacity and time to oversee a large portfolio of impact evaluations. Finally, while impact evaluations helped provide evidence to determine effectiveness, they lacked explanatory power and did not establish whether the experiment would perform well at scale.

During the later part of this period, the MIF was financing projects in a greatly expanded number of topic areas and had the largest team of staff and consultants to date. As a result, the second tranche of financing from MIF II had dwindled and the administrative budget had ballooned. As the MIF began to prepare for its third replenishment, the Donors Committee expressed concerns about the MIF’s lack of strategic focus and ever-growing operating budget. A second OVE evaluation was requested to guide the upcoming replenishment process.

Findings from OVE’s Second Corporate Evaluation

A second OVE evaluation of the MIF was presented to the Donors Committee in 2013 and covered the period of 2005 – 2011. The evaluation found that the MIF’s portfolio was well-aligned with its mandate to promote growth but had yet to find effective ways to meet its poverty reduction mandate; and any benefits beyond its immediate beneficiaries were mixed. The evaluation also noted that, while the MIF had strengthened its experimentation and knowledge functions, these were not yet integrated into the objective of scaling up interventions to produce greater systemic impact. The MIF’s early success with the microfinance industry was not replicated in other areas of the MIF’s engagement; although, it was able to promote the market for venture capital and early-stage equity. The donors endorsed the evaluation’s five recommendations for the MIF: i) assessing impact by implementing a corporate results framework, ii) improving tracking of implementation and results, iii) achieving scale to attain systemic impact, iv) better defining the MIF’s strategy for targeting low-income beneficiaries and promoting poverty reduction, and v) strengthening the MIF’s role as a knowledge institution. For the first time, the Donors and IDB Group leadership specifically identified scaling as an area requiring more effort and improvement. The MIF’s senior management was tasked with defining how scaling would improve in addition to addressing the other recommendations.

Corporate Results Measurement (2016 – 2017) and Transition to IDB Lab

With a new replenishment process on the horizon, MIF management proceeded to implement OVE’s recommendations to strengthen its ability to assess and communicate its value to the IDB Group and its contributions to the region. Two recommendations relevant to scaling were the corporate results framework and achieving scale to attain systemic impact. For the first time, the MIF began to measure key performance corporate results to assess its effectiveness at strategic, organizational, and portfolio levels. The strategic dimension included an indicator of the percentage of projects that had scaled at closing. In 2017, again for the first time, through a newly developed survey, the MIF reported that 17% of projects that closed in 2016 had scaled. Although the MIF was known for its high-risk tolerance and expected to have a high number of failed projects, 17% of scaled projects was perceived as relatively low and generated concern about the MIF’s capacity to be impactful.

As the MIF began its second replenishment process, the IDB Group senior management was compelled to address the MIF’s ballooning operating budget as a necessary preliminary step. During 2016 – 2017, the President’s office of the IDB Group led a significant staff restructuring plan aimed at making the MIF more efficient and financially sustainable. Essentially, the effort sought to reduce the frequency of future replenishment campaigns which required much time and effort and had become less appealing to the donor countries. At an organizational level, the MIF’s personnel was reduced by more than half, from 190 to 95 employees. This reduction had the biggest impact on the MIF’s development effectiveness, knowledge, and communications activities as employees in these units were either let go or transferred to other departments of the IDB that had these functions. In parallel, agreements were made between the MIF and the IDB and IDB Invest to outsource these services for a nominal fee thereby lessening the financial and human resources burden on the MIF but assuring the services would still be provided to its clients.

During this period, at the project level, the iDelta, a new quality-at-entry tool was developed through this outsourcing arrangement. The iDelta included a section on scaling that sought to measure different elements incorporated into project design to improve the likelihood that an operation would scale. The iDelta drew from the resources available through the Scaling Community of Practice. Specifically, the concepts of expansion, replication, and collaboration as well as the “scalability assessment” checklist from the Taking Innovations to Scale: Methods, Applications, and Lessons document informed the development of the iDelta’s scaling section.

Assessing the extent to which projects incorporated scaling activities during design and whether projects had scaled at closing was an important step toward assessing the MIF’s ability to scale and eventually make improvements in its approach. Through the iDelta, data were collected during design which gauged the likelihood of scaling, and via the annual survey at closing to assess whether a project’s results had scaled. Because data were being collected only at the beginning and the end of the project cycle, the information gathered was insufficient for understanding the scaling process, how or if organizations were positioning themselves for scale, and the contextual factors at play to support scaling efforts during implementation. Additionally, there was no information post-closing – when the likelihood of scaling was probably higher – as projects had more time to mature and realize greater impact. Furthermore, there was still no working definition of scaling, the MIF staff had little understanding of the concepts of scaling pathways (e.g., replication, expansion, and collaboration), and analyses of the factors contributing to scaling were non-existent. The restructuring combined with the high uncertainty around MIF III, the second replenishment process, made working on these gaps extremely challenging and were placed on the back burner.

In 2017, the MIF Donors approved another capital replenishment of the MIF (MIF III) for a total of $300 million. It is important to note that MIF III was 60% of the MIF II replenishment and 30% of MIF I, the original contribution. Also, the United States did not enter this round of funding and other non-borrowing member countries decreased the amount of their contributions compared to the previous replenishment; thus more than 50% of the contributions came from borrowing member countries of the IDB.

Enhanced Corporate Results Measurement and Emphasis on Scaling (2018 – 2023)

The new MIF III agreement established 6 strategic priorities and principles to guide the use of the $300 million contribution. They included improving IDB Lab’s approach, results, and impact in the following areas: i) poor and vulnerable populations and inclusion of marginalized groups, ii) scale and replication, iii) knowledge creation, iv) development impact, v) mobilization of resources, and vi) alignment with the IDB Group strategic and operational priorities. For the first time, a funding agreement specified scale as a strategic priority. It is also worth noting the alignment with the IDB Group – also a first – as senior IDB Management saw the need for greater cohesion among the three financing windows of the Group. In 2018, the MIF was rebranded as IDB Lab and the MIF III agreement officially entered into force in 2019.

With a mandate to improve in these areas, IDB Lab updated and digitized its project supervision tools (the Project Status Report, PSR and Project Status Update, PSU) and the iDelta, its quality-at-entry tools to gauge IDB Lab’s performance in the 6 priority areas delineated in the new MIF agreement. IDB Lab’s operational focus also made a sharp turn toward supporting projects that emphasized the promotion of technology adoption and innovation. The Management team also sought to invest more heavily in tech start-ups and developing the entrepreneurial ecosystems in the region. Supporting the application of new technologies was seen as an opportunity to accelerate addressing the region’s most pressing development challenges while mitigating further widening of the digital divide between the well-off and marginalized groups in the region. Specific technologies IDB Lab has sought to leverage include blockchain, artificial intelligence, biotech, digital wallets, etc.

Although all the communication and development effectiveness functions were being outsourced to other units in the IDB or IDB Invest, IDB Lab saw the need to establish a Scaling, Knowledge, and Impact (SKI) unit to boost and more effectively guide the implementation of these functions to fulfill the commitments established in the new agreement. This unit was tasked with measuring and managing the process to update all measurement tools and fully digitize them. It was also responsible for reporting to the Donors Committee on the 6 strategic priority areas, including scaling. During this period, IDB Lab reported annually the percentage of closed projects from the previous year that had scaled.

The table below shows a gradual yet important upward trend in the scaling of its closed projects. It is important to note the information provided was self-reported by the executing agency partners; however, IDB Lab made every effort to validate the results to ensure reliability.

Table 1. Percentage of projects that closed and demonstrated scaling

| Year projects closed | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| % of closed projects that reported scaling | 22% | 29% | 35% | 32.3% | 38% | 48% |

In 2023, an impressive 48% of closed projects successfully scaled through expansion, replication, or collaboration – an increase of 10 percentage points compared to the previous year and exceeding the corporate target of 30%. The primary approach to achieving scale has been through the expansion of the original organization’s business model, resulting in notable client base growth ranging from two to fivefold on average. Out of the projects that scaled, 8% did so in partnership with IDB or IDB Invest, which invested in the expansion of the business model. The 8% figure indicates there is ample room for leveraging scaling opportunities within the IDB Group. It is also worth noting that 28% of the total scaled projects achieved massive scale, which is a decrease of 7 percentage points from 2022. This decline may indicate that these projects are in an early stage of their scaling pathway, highlighting potential opportunities for further growth and development.

However, the annual reporting did not shed light on the key factors that contributed to scaling, much less what can account for the gradual and significant increase from year to year. A one-time internal IDB Lab analysis of scaled projects, done in 2021, identified some useful insights on factors that IDB Lab should be mindful of during design and implementation. The insights are divided into three categories: implementing partner’s capabilities, context, and IDB Lab capacity (see Tables 2, 3 and 4).

Table 2. Design and Implementation Factors Relevant for Scaling by IDB Lab: Implementing Partners

| Implementing Partner | |

| Organizational Capacity | Strong to exceptional capacity. Without exception, the implementing partner had strong institutional capacity and a highly qualified implementation team.

Convening power. Implementers effectively managed to bring in key stakeholders to support with financing, policy support, and in-kind contributions (e.g. advisory services, contacts, etc.).

Honest brokers. Partners were viewed as honest brokers which enhanced their convening power.

Business acumen and entrepreneurial. In addition to technical and project management expertise, implementers possessed business skills that provided a more market-driven approach toward scaling.

Ability to pivot. When projects did not progress as planned, implementers were creative and agile in pivoting initial plans to address market conditions and client needs. |

| Mission Alignment | Strong alignment. The organizational mission was fully aligned with project outcomes.

Fierce determination and commitment to final clients. Projects with high degrees of scaling were driven by relentless and persistent leaders determined to do good for the groups they were serving. |

| Market Analysis and Demand | Project design based on in-depth assessment. A robust analysis before project design defined stakeholder needs ex-ante was critical to a successful project outcome and scaling.

Demand for goods and services is clear from the outset. Specific and well-articulated market demand aided in forging partnerships and uptake of products and services. |

| Lessons Learned and Feedback Loops | Integration of best practices bolstered success. Relying on proven strategies and models accelerated the generation of project results which in turn expedited the scale process. |

Table 3. Design and Implementation Factors Relevant for Scaling by IDB Lab: Context

| Context | |

| Political Climate and Economic Conditions | Public sector support. Transformational projects benefitted from strong public sector support and enabling conditions to influence public policy and further the project’s results.

Response to shocks. The pandemic posed significant challenges but after overcoming those challenges, the organization emerged stronger by either reorienting its business model or through digital transformation. |

| Partnerships | Alignment of interests among partners. Strong collective views and interests among key stakeholders boosted project outcomes and scale. |

Table 4. Design and Implementation Factors Relevant for Scaling by IDB Lab: IDB Lab Capacity

| IDB Lab Capacity | |

| Intermediation | Connections to experts. IDB Lab was proactive in establishing connections with renowned experts in different topics which enabled implementers in more nascent contexts to leapfrog and accelerate progress.

Forging linkages with other IDB Group areas. Country office specialists were instrumental in establishing connections with IDB and IDB Invest staff in related sectors which led to scaling by other IDB Group areas. |

| Technical Acumen | Introduction to new technologies. IDB Lab has promoted the use of new approaches and technologies which enabled organizations to modernize their internal processes or reorient their products and services in more profitable areas. |

This analysis was a one-time effort that involved a lot of staff time and therefore was not repeated. However, the findings did help guide an external in-depth analysis performed in 2022 and to update monitoring tools.

Findings from OVE’s Third Corporate Evaluation

Two years after MIF III officially entered into force, it was time for OVE to conduct another corporate evaluation as financial projections showed that the fund’s resources would be depleted by the end of 2023. The evaluation aimed to provide Donors and IDB Lab Management with an assessment of the extent to which IDB Lab was on track to meet its objectives as set out in the MIF III agreement. The evaluation assessed IDB Lab’s mandate, strategic direction, and corporate setup. It also closely examined the performance of its portfolio of operations and the extent to which it made progress toward its mission. The findings and recommendations were important for informing discussions about the future of IDB Lab and its funding model during the MIF IV replenishment discussions. In 2021, OVE presented five overarching findings, three of which are relevant to scaling (see Table 5).

Table 5. OVE Evaluation Findings Related to Scale

| Numerous Donor Mandates. IDB Lab is expected to support private sector innovations that scale but do so with a focus on the poor and vulnerable populations which may not generate enough revenue for most innovations to be financially viable, and even though its mission as a lab implies that it intervenes long before scaling can be observed. It is expected to support innovations that scale through the rest of the IDB Group, even though it is unclear whether this scaling path is efficient.

Collaboration with IDB Group. While collaboration between IDB Lab and the rest of the IDB Group has significantly increased, there is a need for better defining IDB Lab’s role within the IDB Group, and, as a result, the most efficient and effective way to collaborate with and complement each other. Strengthen Results Tracking, Knowledge Creation, and Learning. Its role as a lab means that learning what works and what does not work, and why, is essential for effectiveness. Attention to knowledge creation and learning has, however, been insufficient, and inadequacies in IDB Lab’s systems and processes pose barriers to systematic learning from operations. |

In summary, OVE found that although IDB Lab had strengthened its experimentation and knowledge functions, these were not yet integrated into the objective of scaling up interventions to produce a greater systemic impact. IDB Lab continued to face significant challenges in achieving the financial viability of private sector innovations that focus on poor and vulnerable populations within limited project timelines. It is expected to support innovations that scale through the rest of the IDB Group, even though it is unclear whether this scaling path is efficient.

To address the findings above, OVE issued a set of recommendations to strengthen IDB Lab’s scaling-up capacity and in coordination with IDB Lab Management outlined three objectives to be implemented in a 2-year timeframe.

- Define a scaling conceptual framework that explains how the impacts of IDB Lab extend beyond those captured by project indicators during execution periods.

- Ensure IDB Lab can measure incidences of scaling for its portfolio.

- Establish a mechanism so IDB Lab and its stakeholders understand how its projects scale through documented and measurable evidence.

As it entered discussions for its third replenishment (MIF IV), IDB Lab began preparing to fortify and consolidate its approach to scaling up and to align it more adequately with its broader strategy of promoting innovation through early-stage entrepreneurship to address the needs of poor and vulnerable populations in the region. Despite significant improvements in the scaling of its closed projects, there existed a clear need to make improvements on several fronts -including OVE’s recommendations- to enable IDB Lab to glean more insights from its portfolio to make more timely and strategic decisions on scaling its operations; thereby increasing further the magnitudes of scale and becoming more impactful.

In-Depth Analysis: Scaling Innovations in Development

The first step in the process involved carrying out an in-depth analysis of its approach to scaling to better understand the fundamental factors at play that lead to the scaling-up of its projects. In 2022, IDB Lab procured a third-party assessment to examine a sample of projects representative of its portfolio that reflect all five thematic verticals and financing instruments. This assessment was much needed to inform the development of a conceptual framework that aligns with a strategy focused on addressing the needs of the poor and vulnerable in LAC through early-stage entrepreneurial innovations. The analysis consisted of an in-depth quantitative and qualitative analysis of a representative sample of 39 projects from the 2017-2021 portfolios. The report provided main findings, areas for improvement, and recommendations.

Main findings

IDB Lab has a relatively large scaling footprint. The analysis revealed that 47% of the 39 projects in the sample scaled. This figure was higher than that captured by IDB Lab’s annual survey of closed projects. This is partly because the analysis examined projects active between 2017 and 2021, which included projects that had closed a few years earlier allowing more time for the scaling effects to manifest. Also, the team oversampled some projects that IDB Lab confirmed had scaled massively to be able to glean insights from those experiences. Finally, the validation of results from IDB Lab’s annual survey started in 2021, so sample projects that closed before 2021 may have suffered from self-reporting bias.

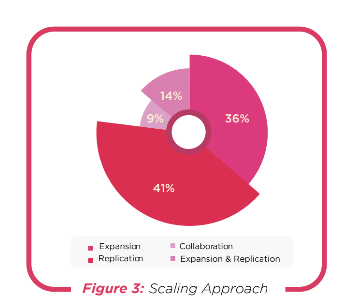

Scaling Pathways and Scalers. Replication and expansion are the most common paths to scale, 41% and 36% respectively. 14% scaled through a combination of expansion and replication while only 9% through collaboration. Of the 22 projects that scaled from the sample of 39, the majority scaled outside of the IDB Group. Projects that scaled through IDB Invest are easier to classify since financing usually goes to the same implementing partner. Also, IDB Invest is continuously seeking private sector deals with development impact for more vulnerable populations which IDB Lab has been more effective at identifying.

Figure 4. Distribution of IDB Lab’s Projects by Scaling Approach

There is a strong positive correlation between project size and scaling level. 80% of scaled projects in the sample received more than US$400,000 and 59% of scaled projects received more than US$1 million.

An experienced implementing partner is one of the best predictors of success. Almost 65% of the projects that scaled were executed by partners that had worked previously with IDB Lab, and only two of the projects that scaled were implemented by a partner less than 5 years old. Moreover, in 100% of interviews with IDB Lab staff specialists, implementing partner capabilities was identified as the top success factor behind scaling. Some of these capabilities are visionary leadership, creativity, risk-taking appetite, and the capacity to learn from failures fast and to adapt to unforeseen shocks.

IDB Lab’s quality-at-entry tool, the iDelta, provides a good assessment of scaling potential. 53% of projects that scaled had an iDelta score of 8-10, and 71% of projects that scaled had an iDelta greater than 5.

Areas for improvement

Measurement

- Although most IDB Lab-supported innovations are intended to scale, IDB Lab does not have a unified framework and set of concepts on scaling up that is consistent end-to-end. There is a lack of clarity in scaling concepts which has ramifications at the project level. In most instances, there are no indicators for tracking scale. Almost half of the projects reviewed for the report (46%) don’t have indicators in their result matrix that reference the specific pathway to scale described in the donors’ memo.

- For most projects that scale through expansion or replication, it is difficult to appreciate how IDB Lab has helped achieve scale without the help of qualitative interviews.

Intermediation and Coordination

- IDB Lab staff in the LAC region play the essential intermediation role with clients, which is the key to helping projects become scalable.

- Interviews with IDB Lab and IDB specialists concur that there is increasing collaboration within IDB Group but that it is informal, happens opportunistically, and does not follow a road map. Interviews also indicate that there is no articulated dialogue between country offices, where most of the scaling intermediation work occurs.

Scaling with IDB Group

- Most IDB Lab projects that scale do it through IDB Invest rather than the IDB. However, significant barriers for IDB Lab projects to scale through IDB Invest continue to exist. IDB Lab and IDB Invest have different risk appetites, and the size of operations don’t overlap, creating a “valley of death” between IDB Lab’s US$ 1.5 million and IDB Invest’s minimum of US$ 10 million. The combination of technical assistance and reimbursable instruments can help facilitate scale-up processes through IDB Invest. Technical cooperation grants could help develop institutional, governance, and market knowledge aspects that facilitate business model development and de-risk investments.

- Although very few IDB Lab projects have scaled up through IDB operations, some cases illustrate the potential for systemic impact.

Reporting and Communication

- IDB Lab does not capitalize on scaling successes either internally or externally. For example, in most cases where projects have scaled, there has been no explicit recognition of IDB Lab’s role in their success by the implementing partner’s external communication efforts. There is no systematic effort within IDB Lab to identify and capitalize on these success stories.

Recommendations

There are four principles that IDB Lab should build on, all tightly linked to capitalizing on its intermediation role.

- First, a consistent and systematic definition of the different dimensions of scale needs to run across all projects, design and assessment tools, and surveys. This is already the case with some tools but it needs to happen across the board. Understanding the difference between scale and growth and deciding whether a scaling strategy will be approached through expansion, replication, or collaboration are two of the most important concepts that every staff member and partner should share.

- Second, success needs to be defined in a way that is consistent with the maturity of the solution being assessed. For projects that have a 3-to-4-year duration, IDB Lab staff should assess and aspire for scalability rather than scale. Scaling, even in the best of cases, takes 8 to 10 years, so it is unrealistic to define it as a success goal. For investment products that have a 10-year horizon, the measure of success should be scale; and scalability should still be included at the assessment stage as well as through the initial years of an operation. In the same vein, tracking what happened after an IDB Lab project closed should be done routinely to capture scale as well as to learn what worked and what failed.

- Third, recognize and develop further the intermediation function that IDB Lab plays in most of the successful projects reviewed, and become an example for other development organizations. This would imply embracing a “greenhouse” approach towards scaling: establishing a safe space where projects get some initial funds and capacity building and are nurtured to eventually scale outside. The intermediation role initially focuses on helping to establish a scaling-up plan, with a clear vision defining scalability and a sequence of steps to get there. The second stage of intermediation prepares the organization to mobilize resources, both human and financial, to implement the plan.

- Fourth, invest in agile tracking as well as in developing an organizational culture that learns from mistakes. The nature of a lab needs to be distinct to offer real value to the IDB Group. IDB loans and IDB Invest equity and loans are focused on delivering on time and at a high quality. In a large organization, room for mistakes is very limited. This realization is the reason behind the drive to develop innovation hubs outside day-to-day operations in DFIs, allowing for a higher risk tolerance, which is necessary to obtain rewards and learn from both failures and successes. Investment in agile tracking is needed so that quick feedback loops can provide just-in-time information for course correction.

Refined Scaling Strategy (2023 and beyond)

The OVE recommendations and the in-depth analysis fed the development of an implementation plan to improve IDB Lab’s scaling capacity. The implementation plan consisted of three phases which began in 2022 with the analysis and wrapped up in 2024.

Phase I – Improving Measurement – 2023

Review and Update of Current Instruments and Innovation Results Framework

A thorough review of indicators used in the iDelta and PSR/PSU was carried out in 2023 to align with the updated conceptual framework on scaling. The updated scaling conceptual framework places greater emphasis on the early-stage innovative nature of the solutions it finances through its projects. Specifically, it incorporates the concept of scalability to complement scaling up while making a distinction between simple growth and sustainability of project results. It also takes into consideration a more realistic timeframe and conditions for project results to scale up.

This view of scale also incorporates three pathways of scaling: expansion (business models that scale through the rapid growth of a company), replication (business models that are seeded in different contexts, be them regional or other, through the private sector or public policy), and collaboration (business models are expanded through partnerships, which may include public or private partnerships).

Finally, the scaling questions focus on three key aspects that will facilitate assessment and future learning from the portfolio. The three sections include (i) progress made toward scaling up, (ii) organizational capacity to achieve scaling up, and (iii) internal/external factors that led/are leading to scaling up.

All the scaling questions under the knowledge section of the PSR and PSU were revamped to align with the new conceptual framework of scaling up as mentioned above. Also, the questions were streamlined and simplified to lessen the burden of reporting on our clients. These new indicators have also been incorporated into IDB Lab’s Innovation Results Framework (IRF) and presented to the Donors Committee in November of 2023.

Phase II – Data Capture & Analysis and Reporting – 2023 and 2024

Data Capture, Analysis, and Reporting for Active, Closed Projects, and Two Years After Completion

IDB Lab proceeded to capture data on closed projects in 2022 and 2023 to assess which operations reached scale, the pathways of scale, the scaling partners, and the magnitudes of scale. An analysis was conducted and a report on results was included as part of IDB Lab’s IRF and presented to the Donors Committee in November of 2023.

The updated PSR and PSU will provide more granular data specific to scalability and will apply to all projects regardless of their stage of implementation. That means that data regarding scaling will be captured for all projects, not only projects that have closed. This will allow for a greater ability to glean insights into clients’ levels of preparation regarding scaling, institutional capacity needs, and identification of partners.

It will also provide information on how the path to scale has evolved during implementation, going beyond capturing data during design (iDelta) and at the closing (annual survey).

Finally, with the new measurement instruments, there will be more standardized data on the internal and external factors influencing the pathways and magnitudes of scale achieved. The new measurement instruments have been updated and the new data sets for the previous semester became available for analysis in Q2 of 2024. The first report with the new data was made available in Q4 of 2024 and will be part of the annual report to Donors via IDB Lab’s IRF going forward.

Lastly, in addition to tracking scale throughout the project cycle – from approval, during implementation, and to close (scalability) –, IDB Lab plans to assess scaling up two years after project completion, on a sample basis.

Training on standard concepts for IDB Lab Staff and Clients

Training activities were planned and began in 2023 and 2024 for IDB Lab staff and clients to address any questions regarding the new conceptual framework and measurement instruments in the online PSR and PSU system.

Phase III – Communication, Continuous Improvement, and Intermediation – 2024 and beyond

Internal and External Communication

The analytical report, Scaling Innovations in Development: The Experience of IDB Lab was published in 2023 and is available in the IDB publications library. The report findings were shared with members of the Donors Committee in an IDB Lab Series in December of 2022.

Results of the report were shared during two external meetings

- a quarterly meeting of the Scaling in February 2023.

- a quarterly meeting of the Moonshots for Development group, a community of innovation agencies in bilateral and multilateral organizations led by IDB Lab in June of 2023.

Analysis Reports to Staff

To make better use of the data gleaned from the PSR and PSU, results will be provided to staff to shed light on how they can improve their intermediation role as it relates to scaling as those IDB Lab staff members who assumed that role were critical in guiding clients on developing scaling plans, identifying partners and additional funding sources, and connecting with experts within the IDB Group and externally; all of which supported the scale-up of their operations.

Complementary Operations Initiatives that Support Scaling Up

In addition to organization and systems changes specifically aimed at scaling, IDB Lab has initiated a series of operational upgrades that seek greater impact as well as scaling success.

- Proactive project sourcing: a more intentional and strategic approach to identifying projects with strong scalability potential during the initial selection phase.

- Programmatic approach: a programmatic approach focused on specific Impact Challenges to build a critical mass of projects addressing shared development issues.

- Reimbursable operations with follow-on investments: Greater emphasis on reimbursable operations that include follow-on investment mechanisms to support models as they begin to scale.

- Ecosystem building: a new approach to building ecosystems that create the enabling conditions necessary for advancing specific sectors or areas of focus.

- IDB Group synergies: a new IDB Group strategy that prioritizes synergies and defines clear scalability pathways for IDB Lab through collaboration with IDB Invest and IDB.

- Knowledge agenda: a knowledge agenda that seeks to deepen understanding of scalability pathways and share lessons learned across stakeholders.

Lessons Learned and Challenges Ahead

In March of 2024, during the IDB’s Annual Meeting in the Dominican Republic, the IDB’s Board of Governors approved a third replenishment of IDB Lab funding (MIF IV). This time the funding envelope consisted of two financing sources: US$200 million from IDB Lab donors and US$200 million from IDB transfers. The funding from the IDB transfers (sovereign resources) is contingent on the actual deposits of the agreed-upon contributions of IDB Lab donors. While contributions from the IDB will likely encourage the public side to be more interested in collaborating with IDB Lab, it is too early to tell whether this will translate into more financing synergies and scale.

The review of the evolution of IDB Lab’s scaling approach highlights five main conclusions:

IDB Lab has been impactful. Measuring Scale is Important for Accountability and Needs to Support Decision Making. IDB Lab from its founding has sought to be ambitious and highly impactful. Changing priorities, leaderships, donor demands, and restructurings have been limiting forces. However, despite these challenges, external reviews have given the organization high marks for its achievements in scale. This has also been confirmed by annual increases in the scaling of its closed projects. Since 2017 (when IDB Lab started capturing data on scaled projects), the percentage of projects that scaled from among all projects that closed in a given year increased from 17% in 2016 to 48% in 2023. Much has been done in the way of defining more precise concepts of scaling tailored to IDB Lab’s mission as an innovation lab, and to measure and assess scale and understand underlying factors. The next step is to leverage the data and make it actionable in real-time to enable projects to pivot as needed during implementation. It also requires deepening IDB Lab staff’s understanding of scaling and providing more guidance so they can better support their clients in the field. The internal assessment and the in-depth analysis both cited implementing partner capacity as a strong predictor of scaling success. Partner selection should take into account specific organizational capacities that are not only required for successful implementation but are also important for reaching scale (see Table 2). In addition to using data for decision-making during implementation, IDB Lab needs to boost its intermediation function as it has shown to be an important service to its clients.

Collaboration Across IDB Group Windows is Essential for Mainstreaming. The assessments on scaling also showed that coordination and a willingness to collaborate among officers in different areas of the IDB Group on occasion led to follow-up funding or adoption of IDB Lab innovation. Thus, mainstreaming scaling and establishing connections for greater scale with IDB and IDB Invest has been very challenging. Often the timing of programming, project design, and deal preparation of three entities that operate somewhat differently does not allow for the desired combining or sequencing of financing. The annual reporting and in-depth analysis both confirmed that scaling with IDB Invest is smoother than with the public sector side of the IDB. IDB Lab’s focus on supporting tech start-ups is more of a natural fit for IDB Invest than IDB. As such, follow-up funding for tech start-ups limits IDB Lab’s impact to transactional scaling versus more transformational scaling. Its new focus on start-ups and the tech entrepreneurial ecosystem, however, can be of value to the IDB’s public sector clients. Therefore, an examination of opportunities for collaboration between IDB and IDB Lab to support these local ecosystems and initiatives could be a way to align agendas and create greater synergies which could lead to more transformational scale.

Donor Demands Prompted Change. The periodic need for requests for funding and the OVE evaluations that shed light on the gaps in its scaling approach undoubtedly played a role in the evolution of its mechanisms, tools, and understanding of scaling. The timing of the requests for funding which triggered the OVE evaluations and subsequent changes in scaling approaches could not be more evident (see Figure 5).

Figure 5. MIF/IDB Lab Replenishments and Scaling Stages

While IDB Lab has made significant strides, commitment, and leadership from IDB Lab management will be critical to ensure the latest modifications and upgrades to its tools, systems, and mechanisms for scaling generate the desired results. Motivation for implementation fidelity needs to go beyond compliance with OVE recommendations. Rather improvements to its scaling approach must be seen as worthwhile investments to its overall effectiveness as an organization seeking to be impactful. Strong results, meaningful scaling, and an in-depth understanding of the scaling process will only strengthen IDB Lab’s value add within the IDB Group and beyond. As part of MIF IV, IDB Lab has shifted its proportion of non-reimbursable financing from 70% to 30% to minimize the need for repeated replenishments. While this change will contribute to its financial sustainability, its long-term organizational sustainability rests on its ability to be impactful and reach greater scale.[/vc_toggle][/vc_column][vc_column width=”1/6″ css=”.vc_custom_1747165945075{margin-left: 20px !important;}”][vc_column_text]

Read the full report

[/vc_column_text][vc_single_image image=”12348″ img_size=”full”][vc_btn title=”Download” style=”custom” custom_background=”#004c72″ custom_text=”#ffffff” align=”center” link=”url:https%3A%2F%2Fscalingcommunityofpractice.com%2Fwp-content%2Fuploads%2F2025%2F05%2FScaling-at-IDB-Labs-FINAL-1.pdf|target:_blank”][/vc_column][/vc_row][vc_row type=”color” bg_color=”#f7f7f7″ padding_top=”0″ padding_bottom=”0″ margin_top=”15″ margin_bottom=”50″][vc_column css=”.vc_custom_1748974876447{margin-bottom: 50px !important;padding-top: 20px !important;padding-right: 20px !important;padding-bottom: 20px !important;padding-left: 20px !important;border-radius: 2px !important;}”][vc_column_text css=”.vc_custom_1748974975189{margin-top: 0px !important;margin-bottom: 0px !important;padding-top: 10px !important;padding-right: 20px !important;padding-bottom: 20px !important;padding-left: 20px !important;background-color: #f7f7f7 !important;}”]

[/vc_column_text][/vc_column][/vc_row]